The Number Of Repeat Sales Falls To Its Lowest Level Since February 2013, Excluding The Covid Era

CCRSI RELEASE – August 2023

(With data through July 2023)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through July 2023. Based on 929 repeat sale pairs in July 2023 and more than 294,058 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

- U.S. COMPOSITE PRICE INDICES BOUNCED IN JULY 2023, UP 1.4% OVER THE PRIOR MONTH. The value-weighted U.S. Composite Index, which is more heavily influenced by high-value trades common in core markets, rose for the second consecutive month to 277 in July 2023, an increase of 1.4% over the prior month. However, the index was down 9.3% in the 12-month period ending in July 2023.

- Meanwhile, the equal-weighted U.S. composite index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, also rose 1.4% to 316 in July 2023. The index edged higher by 0.5% in the 12-month period ending in July 2023.

- The recent bounce in pricing may reflect the lower interest rates witnessed in the second quarter of 2023. The U.S. 10-year treasury reached 4.1% in March 2023 before falling to 3.3% in April 2023, where it hovered for several months before surging to 3.97% at the end of June 2023.

- INVESTMENT GRADE PRICE DECLINES SLOWED ON THE HEELS OF LOWER INTEREST RATES IN THE SECOND QUARTER OF 2023. After seven months of negative price change, the value decay in the investment grade sub-index slowed in July 2023. Four months earlier, the U.S. 10-year treasury yield fell 78 basis points in just over 30 days and hovered in this range for several months, a window of time where many of July’s sale closings could have secured debt financing.

- The investment grade sub-index, which is more heavily influenced by higher-value assets, shuffled 0.3% higher in July 2023, continuing the trend of sideways price gains during the last six months. The index slumped 10.5% over the 12-month period that ended in July 2023.

- However, the general commercial sub-index, more heavily influenced by smaller, lower-priced assets, climbed 1.3% in July 2023, signifying the largest price increase since March 2023. This sub-index gained 2.3% over the 12 months ending in July 2023.

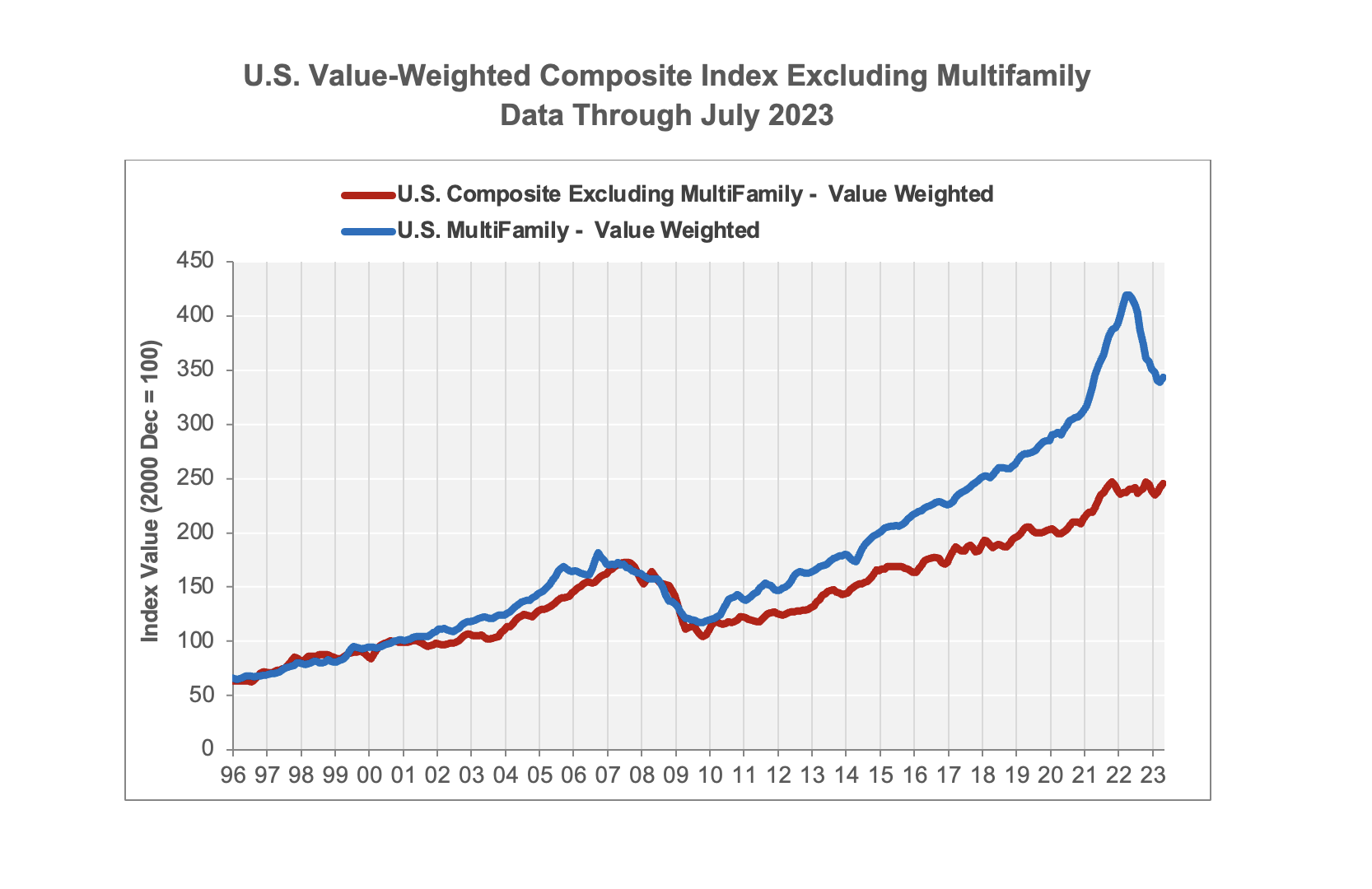

- VALUE-WEIGHTED PRICE DECLINES ARE MOST EVIDENT IN THE MULTIFAMILY SECTOR. Downward pricing momentum has been in place for the last 14 months, with double-digit year-over-year price declines taking hold over the last five months.

- The multifamily sub-index rose by 1.4% in July 2023, its first positive month-over-month increase in the last 13 months. However, the index gave up 18% of its value during the 12 months ending in July 2023. New supply deliveries are weighing on occupancy levels and restricting pricing power to move rents, which have turned negative on a year-over-year basis in approximately 15% of U.S. markets.

- The value-weighted composite index, excluding the multifamily sector, expanded by 1.4% in July 2023, its third monthly increase in a row. The last six months have seen three price declines followed by three price increases. The index has rebounded since May 2023 and is now up 2.3% over the 12-month period ending in July 2023.

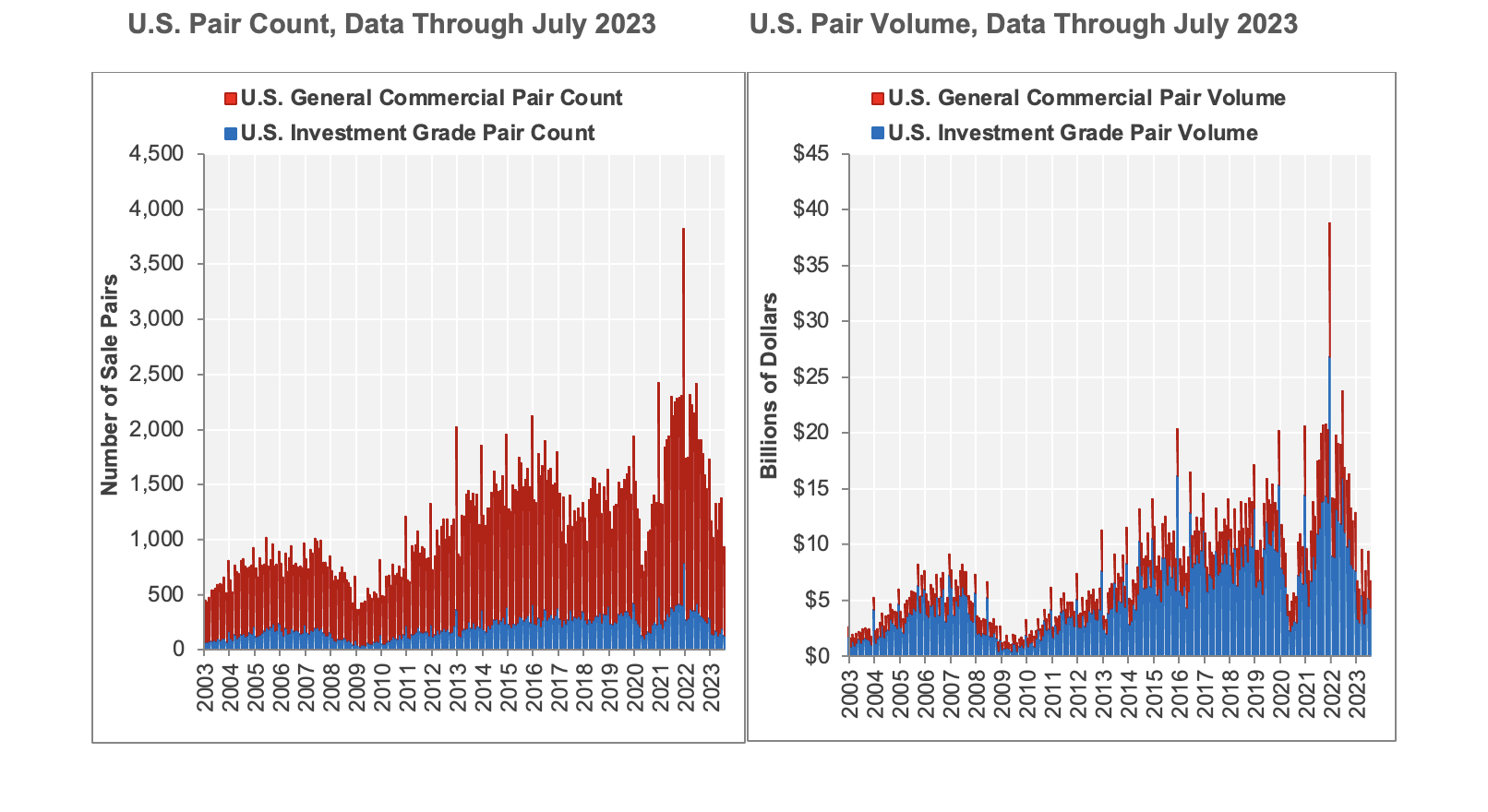

- TRANSACTION VOLUME MIRRORED LEVELS FROM JUNE 2020. Apart from the COVID-era, July 2023 transaction counts were lower than any month since February 2013. The number of trades declined to 929 sales, and total consideration fell to $6.7 billion in July 2023, a 27.7% fall from the prior month. Investment grade transaction volume tumbled by 17.1% in July 2023 to $4.3 billion, while the general commercial segment sank 40.8% from the prior month to $2.5 billion.

- Composite pair volume of $122 billion during the 12 months ending in July 2023 was 50.6% lower than the 12-month period that ended in July 2022. The nose-dive in volume was larger in the investment grade segment, which snapped lower by 56.2% over the 12 months that ended in July 2023 compared to the same period ending in July 2022. The investment grade segment accounted for about 59.2% of the overall annual transaction volume during the last 12 months. The general commercial segment, which accounted for about 40.8% of the 12-month transaction volume, collapsed by 39.4% over the 12 months ending in July 2023.

- LIQUIDITY MEASURES SHOW THAT PRIVATE CAPITAL REMAINS ACTIVE. For priced for-sale listings of smaller assets, the average time on the market dropped by 6.5% in the 12 months ending in July 2023 as the sale-price-to-asking-price ratio widened by 1.7 percentage points to 93.2%. Meanwhile, the share of properties withdrawn from the market by discouraged sellers increased by 3.6 percentage points to 25.6% during the 12 months ending in July 2023.

- DISTRESSED REPEAT SALES REMAIN HISTORICALLY LOW. Just 26 of the 929 repeat-sale trades in July 2023, or about 2.8%, were distressed sales. General commercial distressed sales accounted for 20 of the distressed trades in July 2023, or 2.2% of all repeat-sales trades. Only six investment-grade distressed sales were recorded in the month, accounting for 0.6% of all repeat sales trades.

About The CoStar Commercial Repeat-Sale Indices

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which are reported monthly, 30 sub-indices in the CoStar index family are reported quarterly. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country). The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all the sales pairs are used to create a price index. Historical price indices are revised as new data is recorded.

MEDIA CONTACT:

Matthew Blocher, Vice President, Marketing & Communications, CoStar Group (mblocher@costar.com).

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices, and disclaimer, please visit https://costargroup.com/costar-news/ccrsi/.

ABOUT COSTAR GROUP, INC.

CoStar Group, Inc. (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret, and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. Realla is the UK’s most comprehensive commercial property digital marketplace. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time we plan to utilize our corporate website, www.costargroup.com, as a channel of distribution for material company information. For more information, visit www.CoStarGroup.com