CoStar Group First Quarter Revenue Grows 20% and Net Income Increases 63% Year-Over-Year

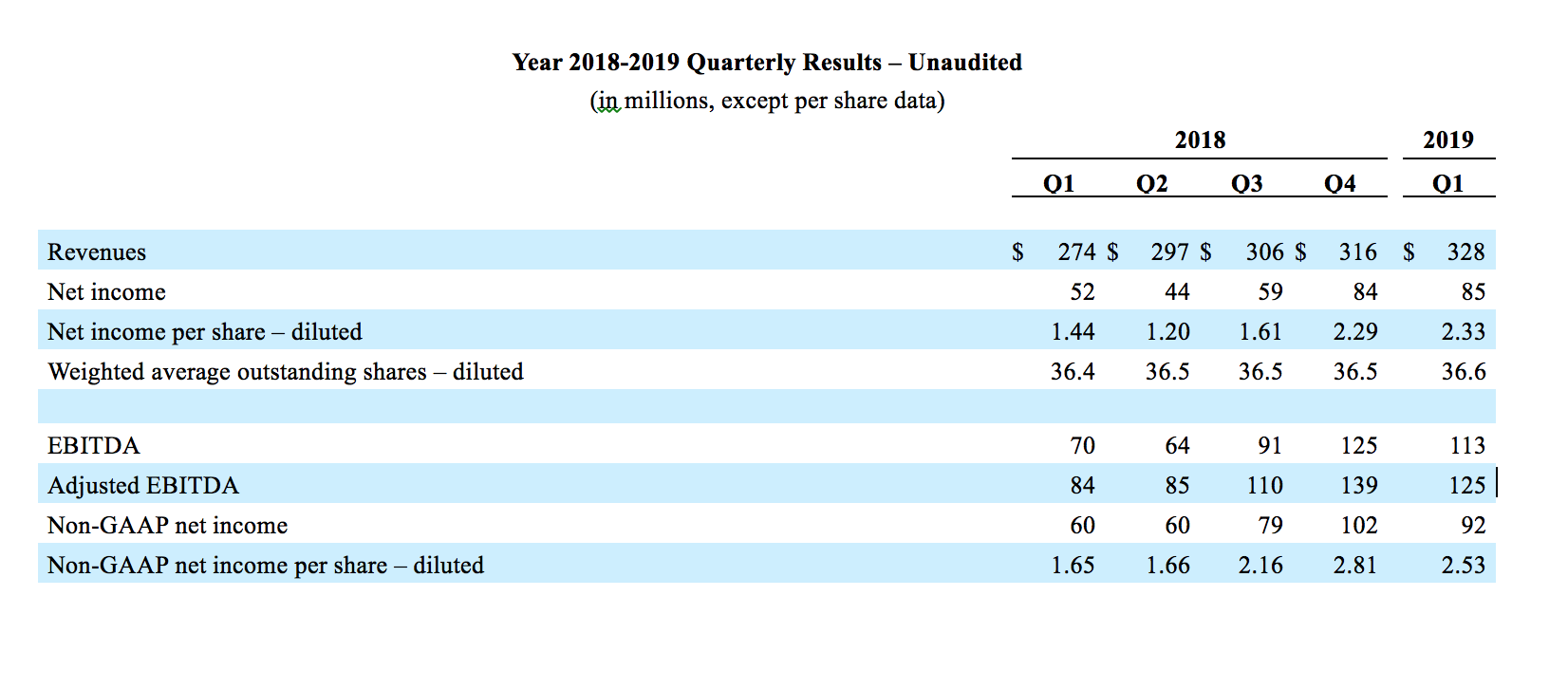

WASHINGTON – April 23, 2019 - CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces, announced today that revenue for the quarter ended March 31, 2019, was $328 million, an increase of 20% over revenue of $274 million for the first quarter of 2018. Net income for the first quarter of 2019 was $85 million, an increase of 63% over net income of $52 million for the first quarter of 2018.

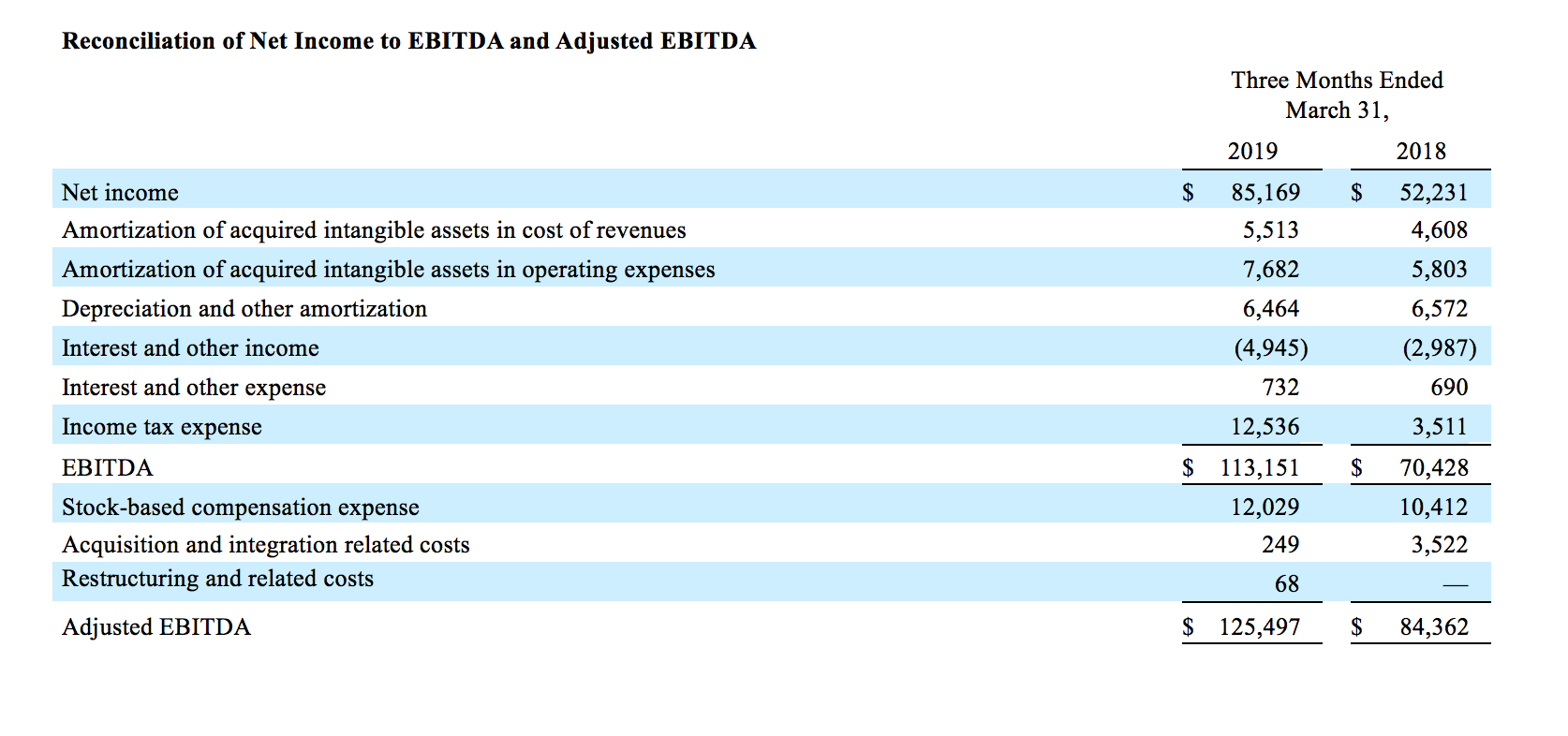

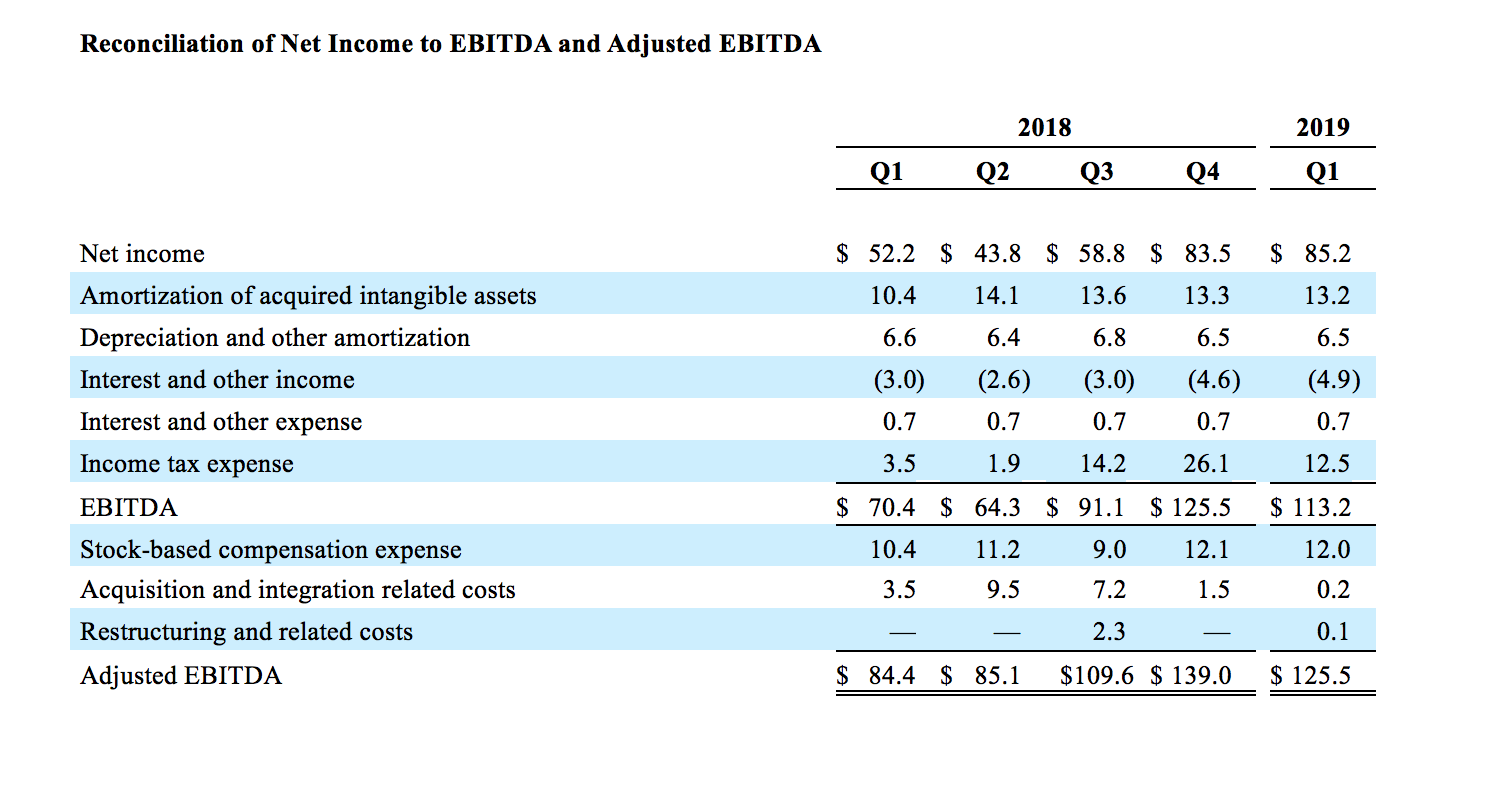

EBITDA for the first quarter of 2019 was $113 million, an increase of 61% versus EBITDA of $70 million for the first quarter of 2018. Adjusted EBITDA (which excludes stock-based compensation, acquisition and integration related costs and other items as described below) for the first quarter of 2019 was $125 million, an increase of 49% compared to adjusted EBITDA of $84 million for the first quarter of 2018.

“The strong revenue and earnings growth we showed in 2018 has continued into the first quarter of 2019,” said Andrew C. Florance, Founder and Chief Executive Officer of CoStar Group. “In the first quarter of 2019, our sales team generated $48 million in company-wide net new bookings, an increase of 36% year-over-year. Apartments.com had an exceptionally strong sales quarter, growing quarterly net new bookings by 40% year-over-year, exceeding even the record net new bookings level we achieved in the fourth quarter of 2018.”

Florance continued, “Unique visitors to our network of marketplaces grew 29% year-over-year from 38 million in the first quarter of 2018 to 49 million in first quarter of 2019. With strong traffic growth and a robust product development pipeline for Apartments, LoopNet, and CoStar we believe we will continue to deliver strong consistent revenue growth.”

As of March 31, 2019, the Company had approximately $1.2 billion in cash, cash equivalents and long-term investments, and no outstanding debt.

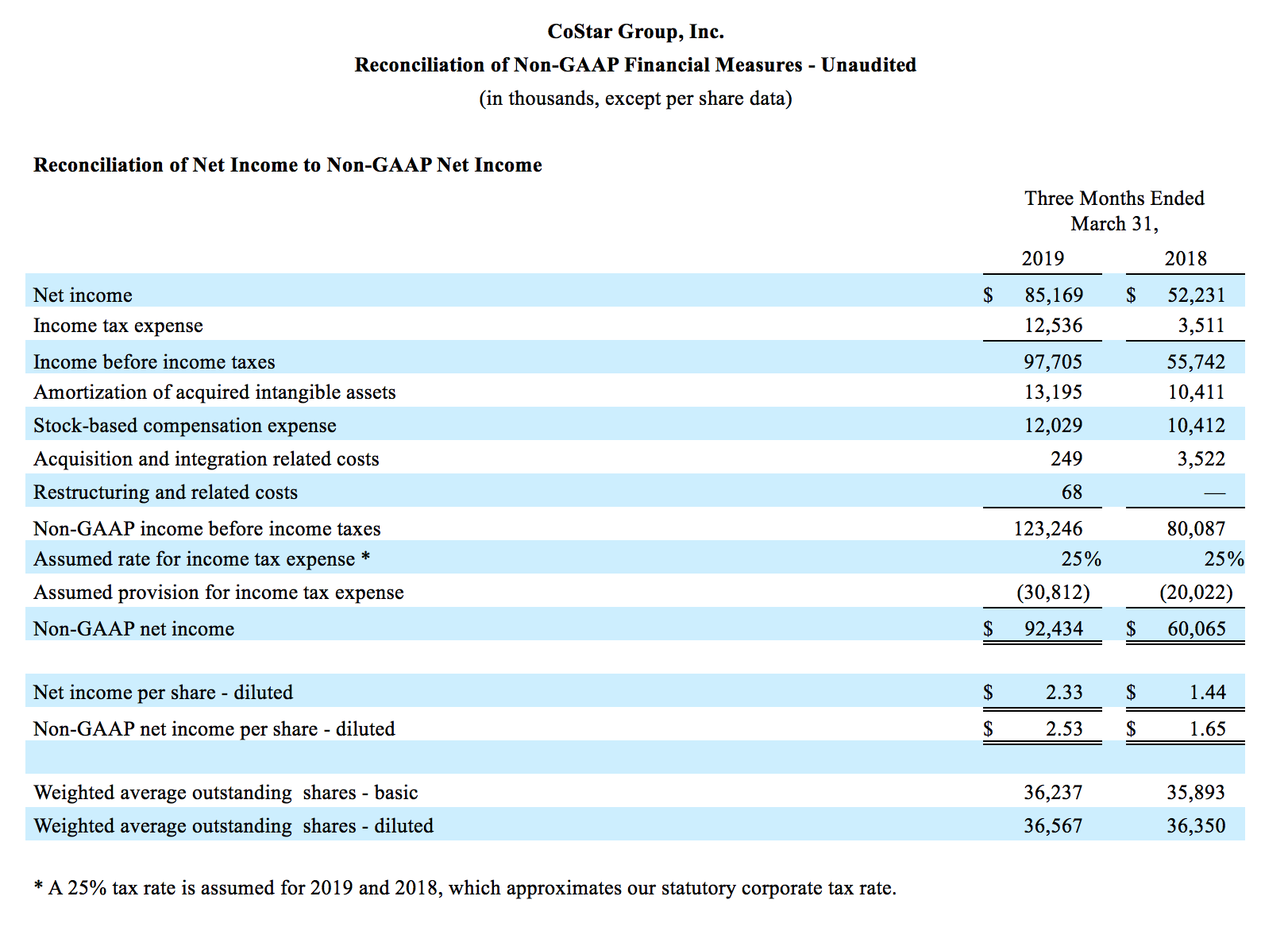

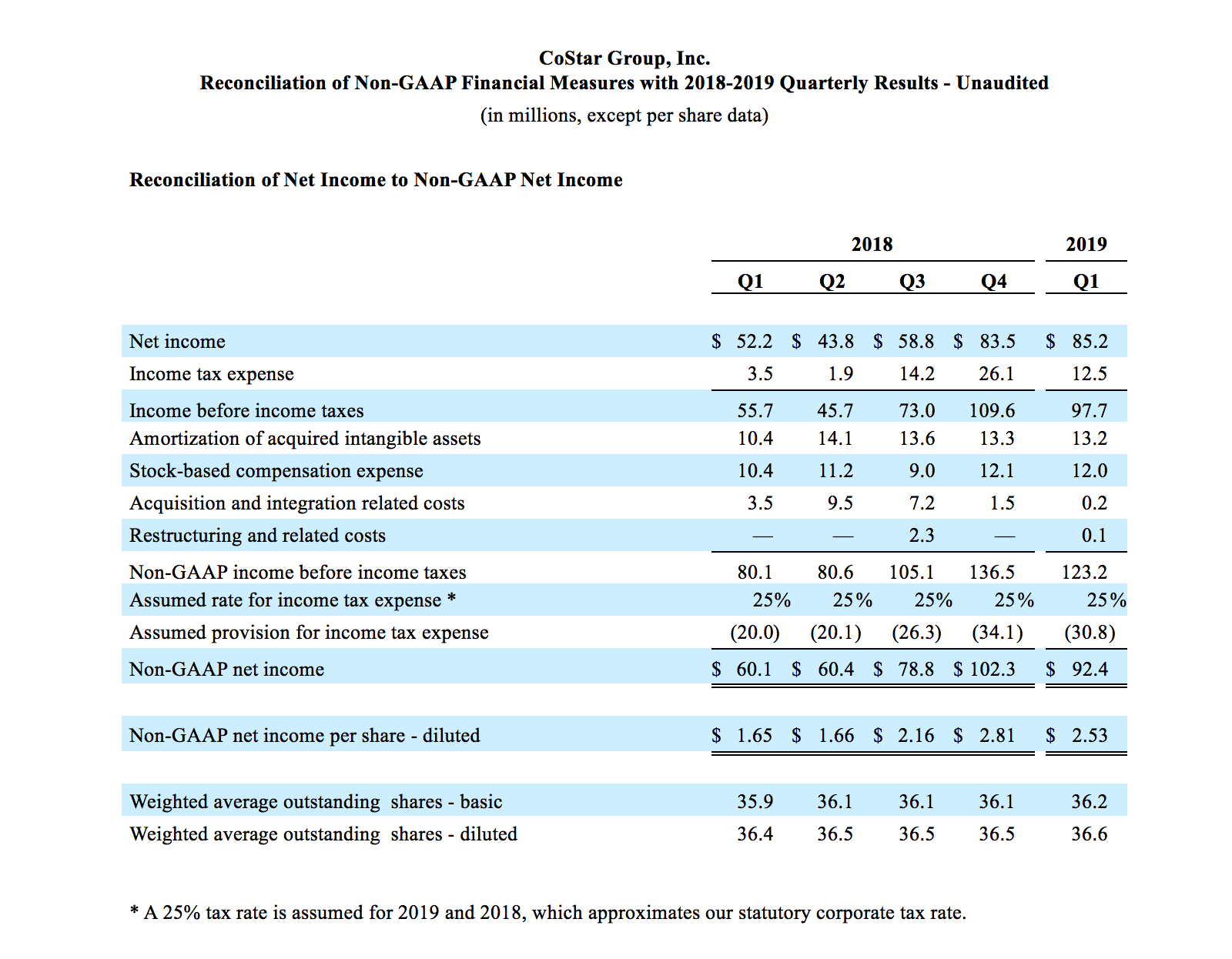

Non-GAAP net income for the first quarter of 2019 (which excludes amortization of acquired intangible assets, stock-based compensation and other items as described below) was $92 million or $2.53 per diluted share, an increase of $32 million or 54% versus the first quarter of 2018.

2019 Outlook

The Company continues to expect revenue in the range of $1,370 million to $1,380 million for the full year of 2019. We expect revenue for the second quarter of 2019 in the range of $333 million to $337 million, representing revenue growth of 13% over the second quarter of 2018 at the midpoint of the range. The revenue growth outlook in the second quarter of 2019 is lower than the reported first quarter revenue growth rate as we passed the anniversary of the ForRent acquisition and discontinued certain ForRent revenue streams that contributed to the 2018 revenue results.

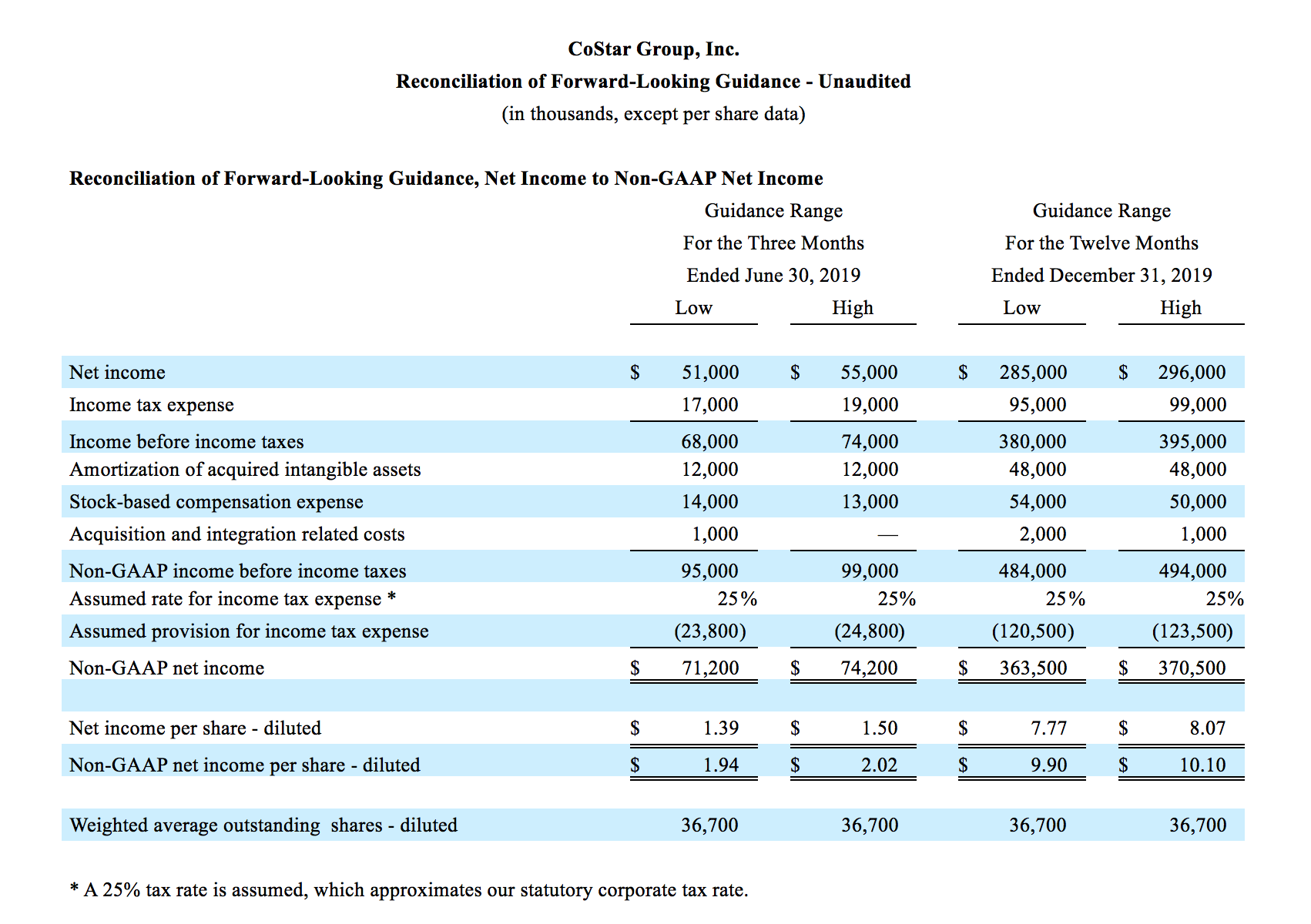

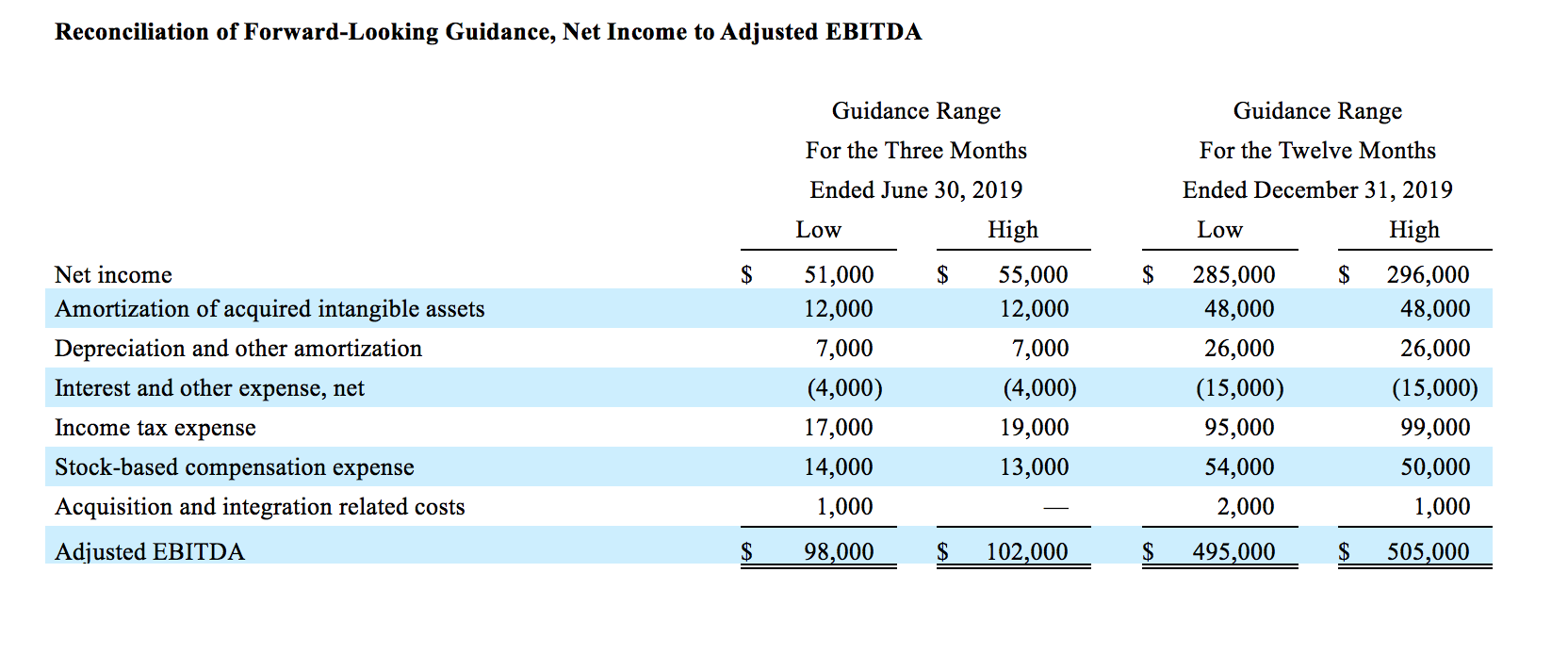

The Company continues to expect adjusted EBITDA in a range of $495 million to $505 million for the full year of 2019. For the second quarter of 2019, the Company expects adjusted EBITDA in a range of $98 million to $102 million.

We expect full-year 2019 non-GAAP net income per diluted share in a range of $9.90 to $10.10, based on 36.7 million shares, an increase of $0.10 at the midpoint versus the previously provided outlook, primarily as a result of increased interest income earned on cash balances. For the second quarter of 2019, we expect non-GAAP net income per diluted share in a range of $1.94 to $2.02 based on 36.7 million shares. These ranges include a non-GAAP tax rate of 25%.

The preceding forward-looking statements reflect CoStar Group’s expectations as of April 23, 2019, including forward-looking non-GAAP financial measures on a consolidated basis. Given the risk factors, uncertainties and assumptions discussed above, actual results may differ materially. Other than in publicly available statements, the Company does not intend to update its forward-looking statements until its next quarterly results announcement.

Reconciliation of EBITDA, adjusted EBITDA, non-GAAP net income and non-GAAP net income per diluted share and all of the disclosed non-GAAP financial measures to their GAAP basis results are shown in detail below, along with definitions for those terms. A reconciliation of forward-looking non-GAAP guidance to the most directly comparable GAAP measure, net income, can be found within the tables included in this release.

Non-GAAP Financial Measures

For information regarding the purpose for which management uses the non-GAAP financial measures disclosed in this release and why management believes they provide useful information to investors regarding the Company’s financial condition and results of operations, please refer to the Company’s latest periodic report. EBITDA is a non-GAAP financial measure that represents GAAP net income attributable to CoStar Group before interest and other income (expense), loss on debt extinguishment, income taxes, depreciation and amortization. Adjusted EBITDA is a non-GAAP financial measure that represents EBITDA before stock-based compensation expense, acquisition- and integration-related costs, restructuring costs and settlements and impairments incurred outside the Company’s normal course of business. Non-GAAP net income is a non-GAAP financial measure determined by adjusting GAAP net income attributable to CoStar Group for stock-based compensation expense, acquisition- and integration-related costs, restructuring costs, settlement and impairment costs incurred outside the Company's normal course of business and loss on debt extinguishment, as well as amortization of acquired intangible assets and other related costs, and then subtracting an assumed provision for income taxes. In 2019, the Company is assuming a 25% tax rate in order to approximate our statutory corporate tax rate excluding the impact of discrete items. Non-GAAP net income per diluted share is a non-GAAP financial measure that represents non-GAAP net income divided by the number of diluted shares outstanding for the period used in the calculation of GAAP net income per diluted share. For periods with GAAP net losses and non-GAAP net income, the weighted-average outstanding shares used to calculate non-GAAP net income per share includes potentially dilutive securities that were excluded from the calculation of GAAP net income per share as the effect was anti-dilutive.

Earnings Conference Call

Management will conduct a conference call at 5:00 PM EDT on Tuesday, April 23, 2019 to discuss earnings results for the second quarter and the Company’s outlook. The audio portion of the conference call will be broadcast live over the Internet at investors.costargroup.com. To join the conference call by telephone, please dial (800) 230-1096 (from the United States and Canada) or (612) 332-0107 (from all other countries) and refer to conference code 466402. An audio recording of the conference call will be available for replay approximately one hour after the call's completion and will remain available for a period of time following the call. To access the recorded conference call, please dial (800) 475-6701 (from the U.S. and Canada) or (320) 365-3844 (from all other countries) using access code 466402. The webcast replay will also be available in the Investors section of CoStar Group's website for a period of time following the call.

ALL INQUIRIES:

Scott Wheeler, Chief Financial Officer,

(202) 336-6920, swheeler@costar.com

Richard Simonelli, Vice President, Investor Relations,

(202) 346-6394,

rsimonelli@costar.com

# # #

About CoStar Group, Inc.

CoStar Group, Inc. (NASDAQ: CSGP) is the leading provider of commercial real estate information, analytics and online marketplaces. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. LoopNet is the most heavily trafficked commercial real estate marketplace online with nearly 6 million monthly unique visitors. Realla is the UK’s most comprehensive commercial property digital marketplace. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. CoStar Group’s websites attracted an average of over 49 million unique monthly visitors in aggregate in the first quarter of 2019. Headquartered in Washington, DC, CoStar maintains offices throughout the U.S. and in Europe and Canada with a staff of over 3,700 worldwide, including the industry’s largest professional research organization. For more information, visit www.costargroup.com.

This news release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about CoStar Group's financial expectations, the Company's plans, objectives, expectations and intentions and other statements including words such as “hope,” "anticipate," "may," "believe," "expect," "intend," "will," "should," "plan," "estimate," "predict," "continue" and "potential" or the negative of these terms or other comparable terminology. Such statements are based upon the current beliefs and expectations of management of CoStar Group and are subject to significant risks and uncertainties. Actual results may differ materially from the results anticipated in the forward-looking statements. The following factors, among others, could cause or contribute to such differences: the risk that the trends stated or implied by this release cannot or will not be sustained at the current pace, including trends related to revenue, net income, non-GAAP net income, EBITDA, adjusted EBITDA, and sales; the risk that the Company is unable to sustain current revenue and earnings growth rates or increase them; the risk that strong traffic growth and the company’s product development pipeline do not result in strong consistent revenue growth as stated in this release; the risk that revenues for the second quarter and full year 2019 will not be as stated in this press release; the risk that net income for the second quarter and full year 2019 will not be as stated in this press release; the risk that adjusted EBITDA for the second quarter and full year 2019 will not be as stated in this press release; the risk that non-GAAP net income and non-GAAP net income per diluted share for the second quarter and full year 2019 will not be as stated in this press release; and the risk that the tax rate estimates stated in this press release are incorrect or may change. Additional factors that could cause results to differ materially from those anticipated in the forward-looking statements can be found in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2018, which is filed with the SEC, including in the “Risk Factors” section of that filing, and the Company’s other filings with the SEC available at the SEC’s website (www.sec.gov). CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.