Latest Composite Price Indices Show Modest Uptick in August but Still Down from Pre-Pandemic Peaks

CCRSI RELEASE – September 2020

(With data through August 2020)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through August 2020. Based on 823 repeat sale pairs in August 2020 and more than 230,445 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

-

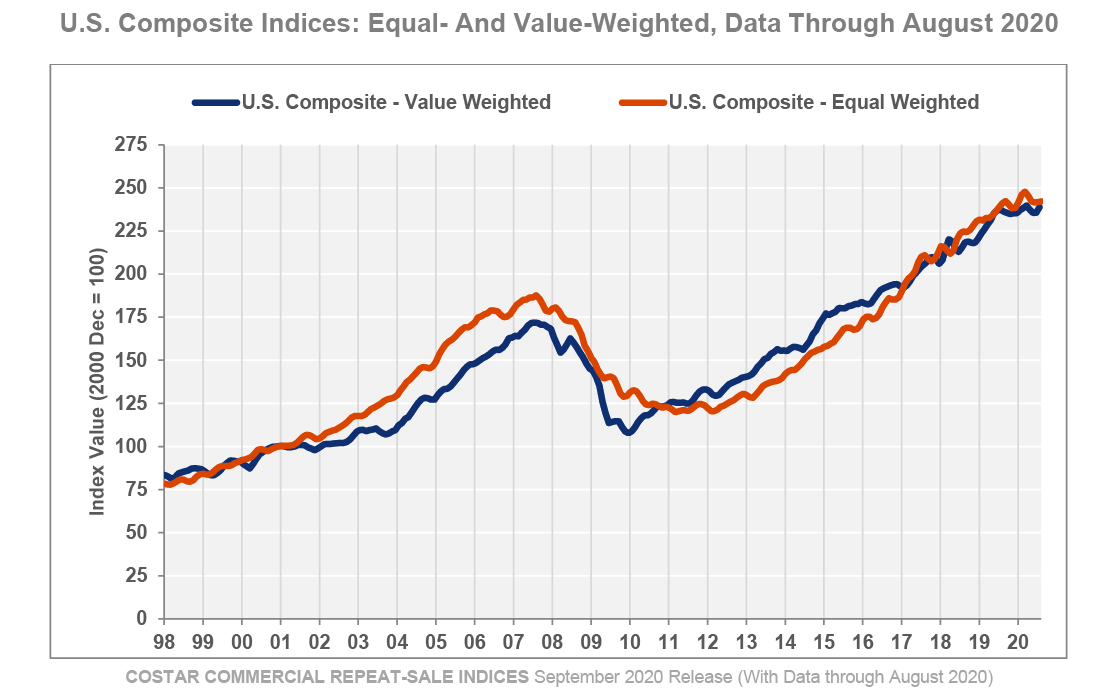

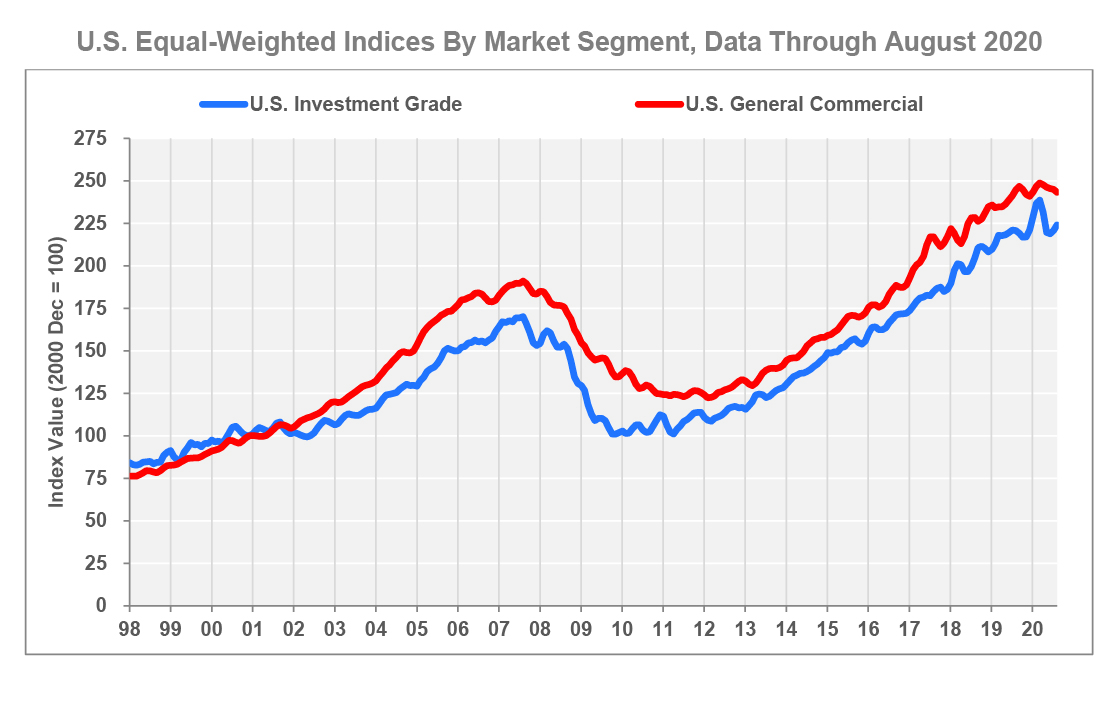

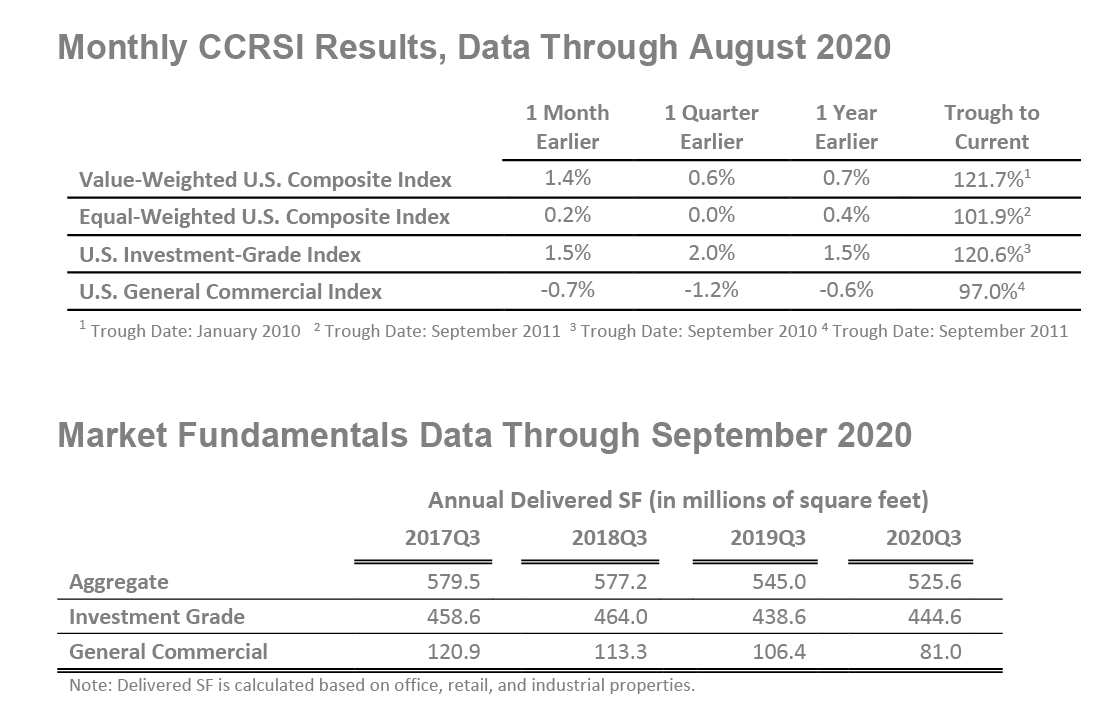

COMPOSITE PRICE INDICES REVERSE PRIOR MONTH’S LOSSES IN AUGUST BUT REMAIN BELOW PRE-PANDEMIC LEVELS. Both of CCRSI’s two major composite price indices showed modest growth in August 2020, stemming from losses sustained in May 2020 and June 2020. However, both composite indices remained below pre-pandemic levels. The equal-weighted U.S. Composite Index, which weights each trade equally and therefore reflects the more numerous, but lower-priced property sales typical of smaller markets, ticked up 0.2% in August 2020 but was still down 2.3% from its pre-pandemic peak reached in March 2020. Meanwhile, the valueweighted U.S. Composite Index, which puts more weight on higher-value assets common in larger markets, rose 1.4% in August 2020, but was still down 0.4% from its April 2020 pre-pandemic high.

-

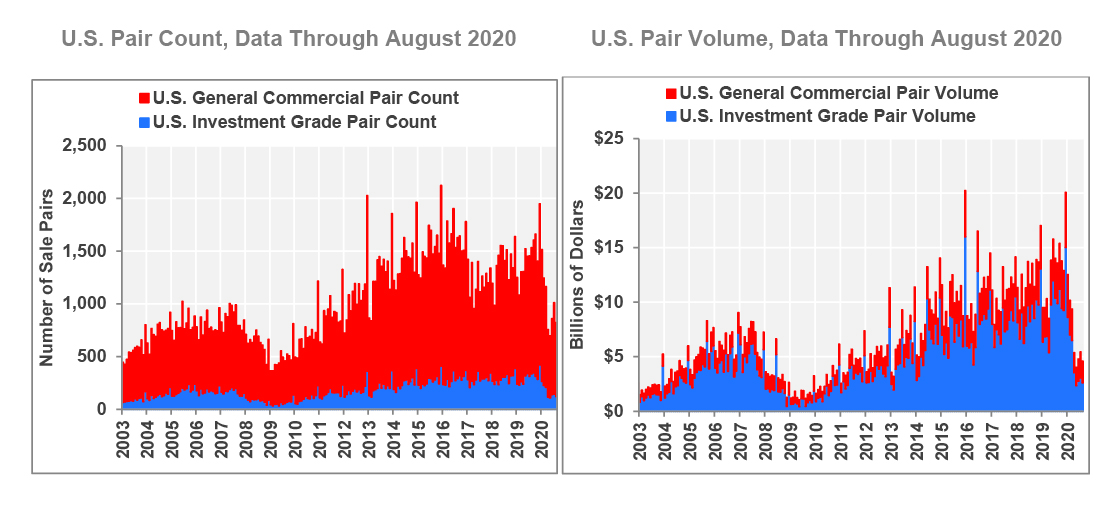

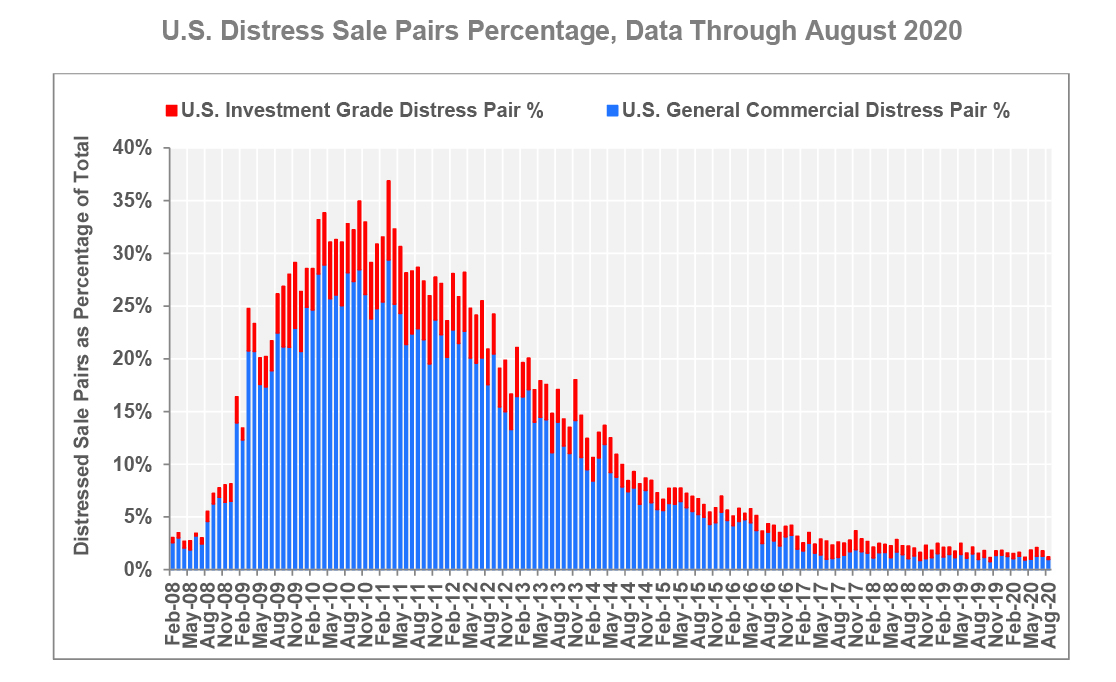

SALES VOLUME CONTINUED TO DECLINE. Composite pair volume of $56.2 billion in the eight-month period that ended in August 2020 was down 40.8% from the eightmonth period that ended in August 2019 as investors remained cautious amid an uncertain economic environment. There was deceleration in deal volume across the size and building-quality spectrum, with repeat-sale transaction volume down 45.9% in the Investment-Grade segment and 28.4% in the General Commercial segment in the first eight months of 2020 compared to the same period in 2019.

-

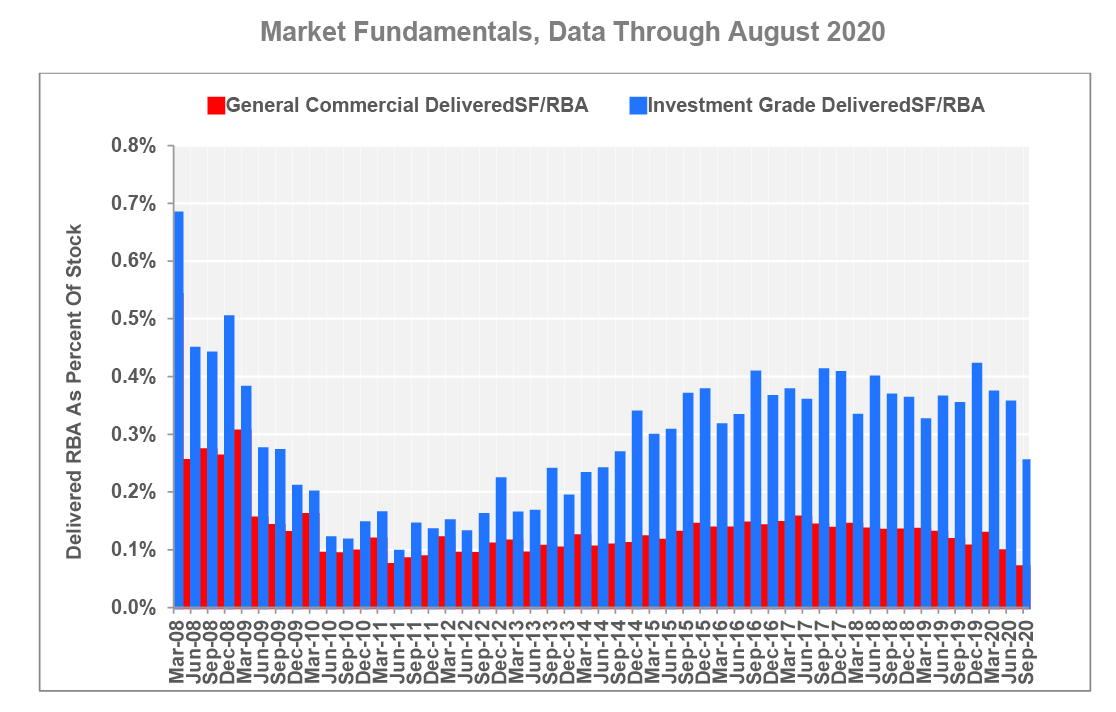

LOWER LEVELS OF CONSTRUCTION MITIGATE DOWNSIDE PRESSURES ON DEMAND. Deliveries as a share of stock across the three major property types — office, retail, and industrial — are projected to total 525.6 million SF in the 12-month period ending in September 2020, down 3.6% from the 12-month period ending in September 2019. Moreover, the rate of construction completions going into the pandemic was also much lower than at the peak of the last cycle in 2007-08. During the height of the last cycle, quarterly deliveries averaged 0.44% of total stock in 2007- 08. In the last four quarters through September 2020, deliveries averaged just 0.24% of total inventory. More subdued construction levels going into a downturn may help to blunt the impact of weaker demand on vacancy rates.

About the CoStar Commercial Repeat-Sale Indices

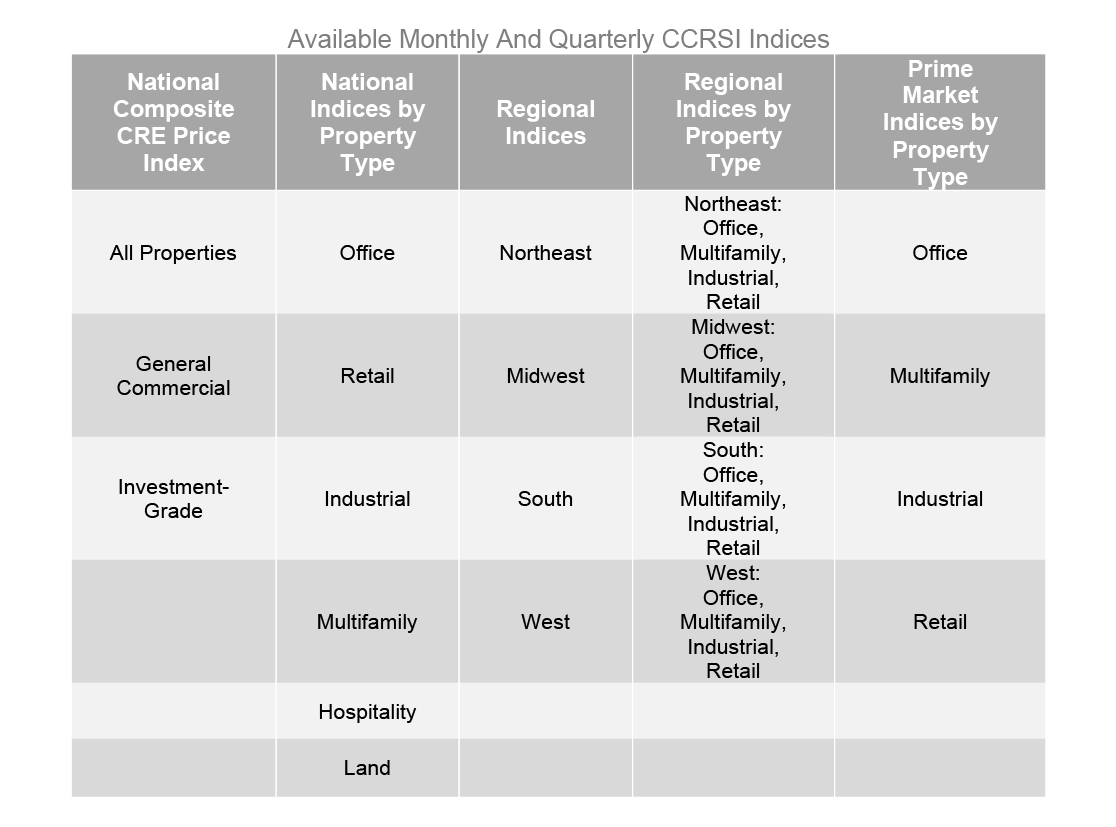

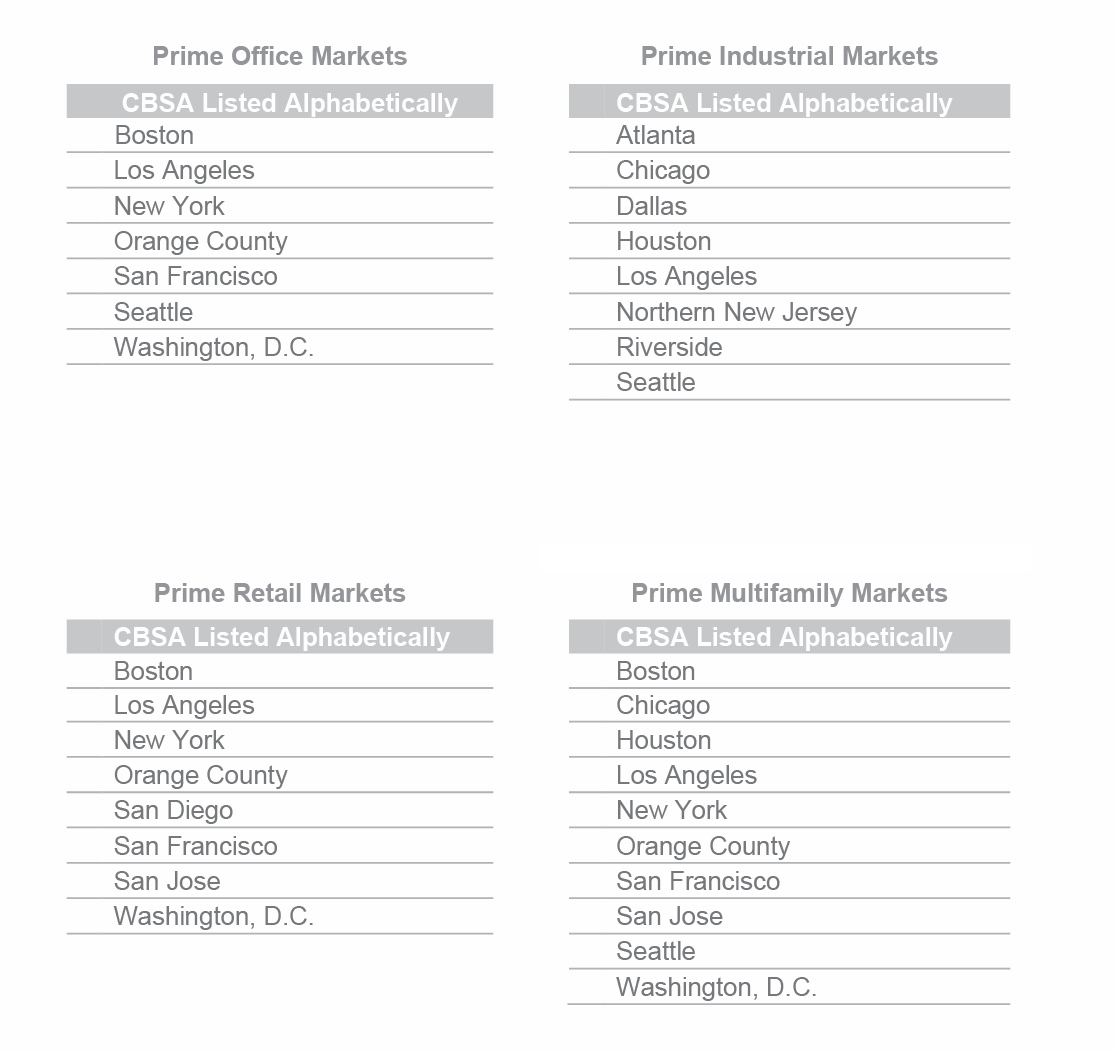

The CoStar Commercial Repeat-Sale Indices (CCRSI) is the most comprehensive and accurate measure of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which we report monthly, we report quarterly on 30 sub-indices in the CoStar index family. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country).

The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a COSTAR COMMERCIAL REPEAT-SALE INDICES September 2020 Release (With Data through August 2020) sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all of the sales pairs are used to create a price index.

Media Contact:

Gay Beach, Senior Director of Marketing Communications, CoStar Group (gbeach@costargroup.com).

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices and disclaimer, please visit https://costargroup.com/costar-news/ccrsi.

ABOUT COSTAR GROUP, INC.

CoStar Group, Inc. (NASDAQ: CSGP) is the leading provider of commercial real estate information, analytics and online marketplaces. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality sector. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online with over 7 million monthly unique visitors. Realla is the UK’s most comprehensive commercial property digital marketplace. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. CoStar Group’s websites attracted an average of approximately 62 million unique monthly visitors in aggregate in the second quarter of 2020. Headquartered in Washington, DC, CoStar maintains offices throughout the U.S. and in Europe, Canada and Asia with a staff of over 4,200 worldwide, including the industry’s largest professional research organization. For more information, www.costargroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations, beliefs, intentions or strategies regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that the trends represented or implied by the indices will not continue or produce the results suggested by such trends, including trends related to market fundamentals, pricing, deliveries, vacancy rates, demand and transaction volume; and the risk that deliveries as a share of stock across the three major property types for the 12-month period ending in September 2020 will not be as expected and stated in this release. More information about potential factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10- K for the year ended December 31, 2019, and CoStar’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, COSTAR COMMERCIAL REPEAT-SALE INDICES September 2020 Release (With Data through August 2020) as well as the company's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update such statements, whether as a result of new information, future events or otherwise.