Repeat-Sale Indices Witnessed Price Gains In The Third Quarter Of 2023

CCRSI RELEASE – October 2023

(With data through September 2023)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through September 2023. Based on 1,132 sale pairs in September 2023 and more than 296,739 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

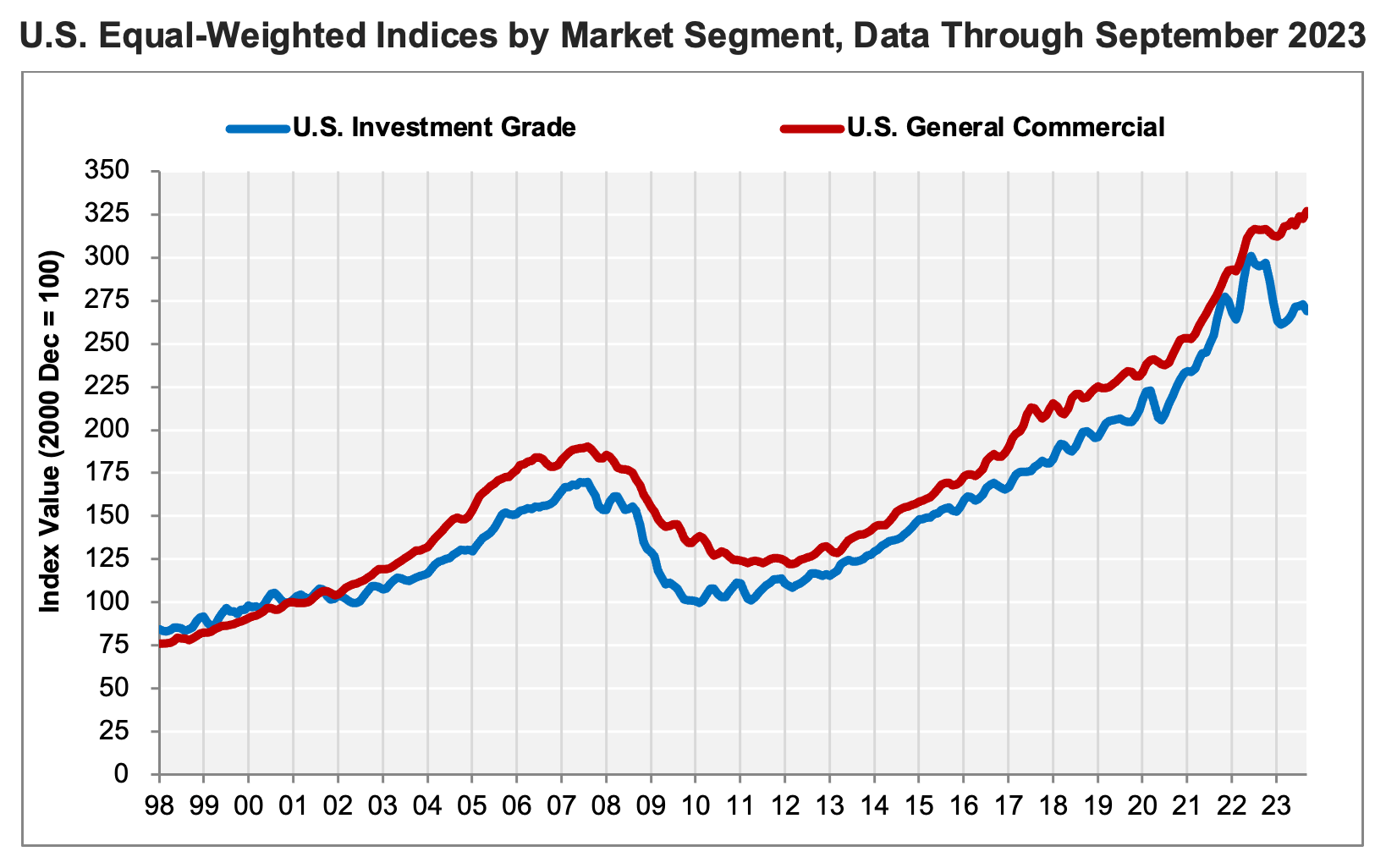

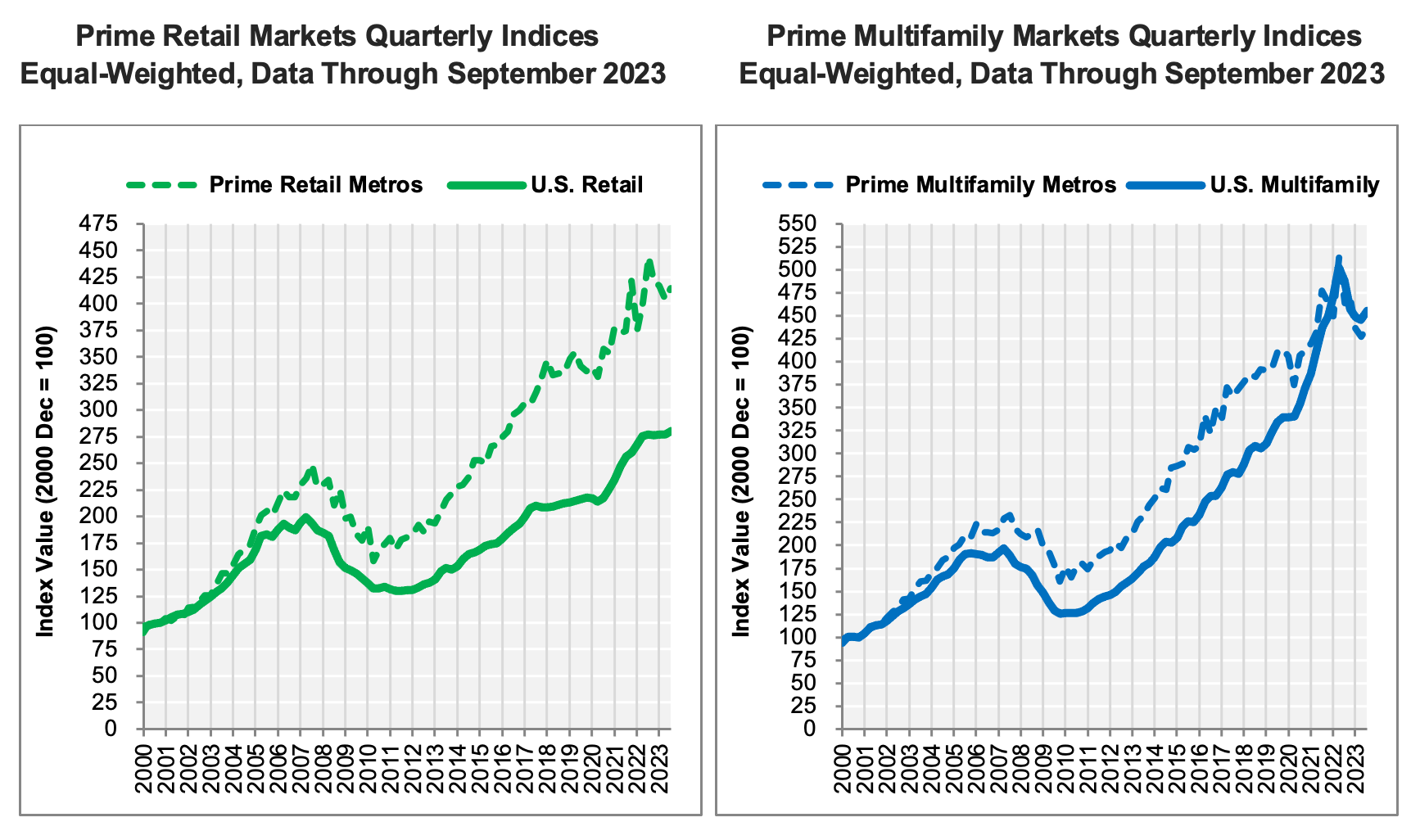

- U.S. COMPOSITE PRICE INDICES ADVANCED IN SEPTEMBER 2023. The value-weighted U.S. Composite Index, which is more heavily influenced by high-value trades common in core markets, rose to 273, an increase of 0.5% over the prior month. However, the index dipped 9.1% in the 12-month period ending in September 2023.

- Meanwhile, the equal-weighted U.S. Composite Index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, climbed 1% to 318 in September 2023 over August 2023. The index also expanded by 1.5% in the 12-month period ending in September 2023.

- Recent price action was influenced by lower interest rates seen in the second quarter of 2023 that led to increased price stability among third quarter closings. The yield on the U.S. 10-year treasury note reached 3.3% in April 2023 before leaping to 4.6% by the end of September 2023.

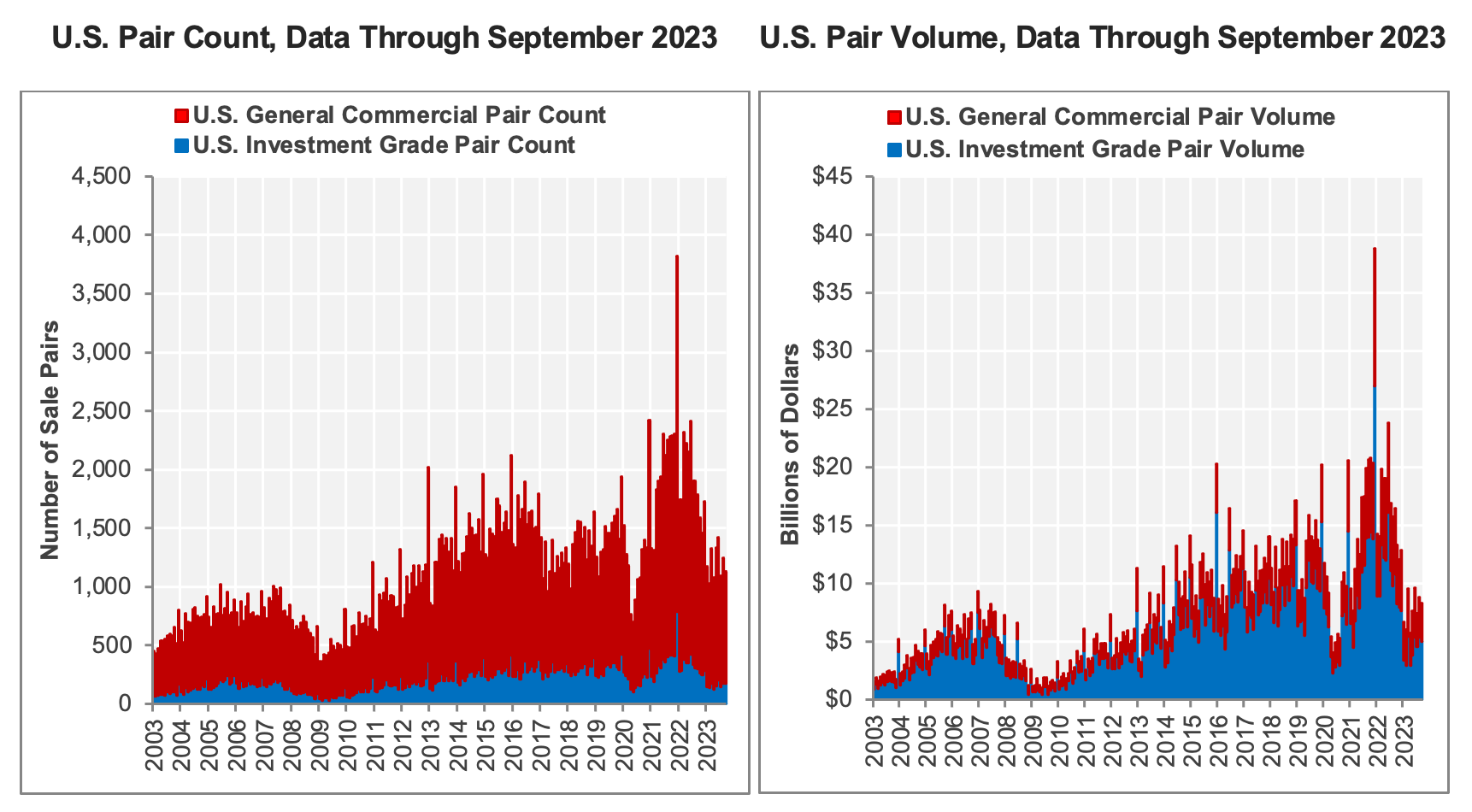

- TRANSACTION COUNTS FELL 37% FROM THE PRIOR YEAR. September 2023 transaction counts mirrored levels last seen in the first quarter of 2020. The number of repeat sales retreated to 1,132 transactions, and total consideration fell to $8.3 billion in September 2023, a 5.7% decline from the prior month. Investment grade transaction volume dipped 6.9% in September 2023 to $5 billion, while the general commercial segment settled 3.9% lower than the prior month at $3.3 billion.

- Composite pair volume of $108 billion during the 12 months ending in September 2023 was 54.8% lower than the 12-month period that ended in September 2022. The collapse in volume was larger in the investment grade segment, which tumbled by 60.4% over the 12 months that ended in September 2023 compared to the same period ending in September 2022. The investment grade segment accounted for about 60.2% of the overall annual transaction volume during the 12 months that ended in September 2023. The general commercial segment, which accounted for about 39.8% of the 12-month transaction volume, plunged 44% over the 12 months ending in September 2023.

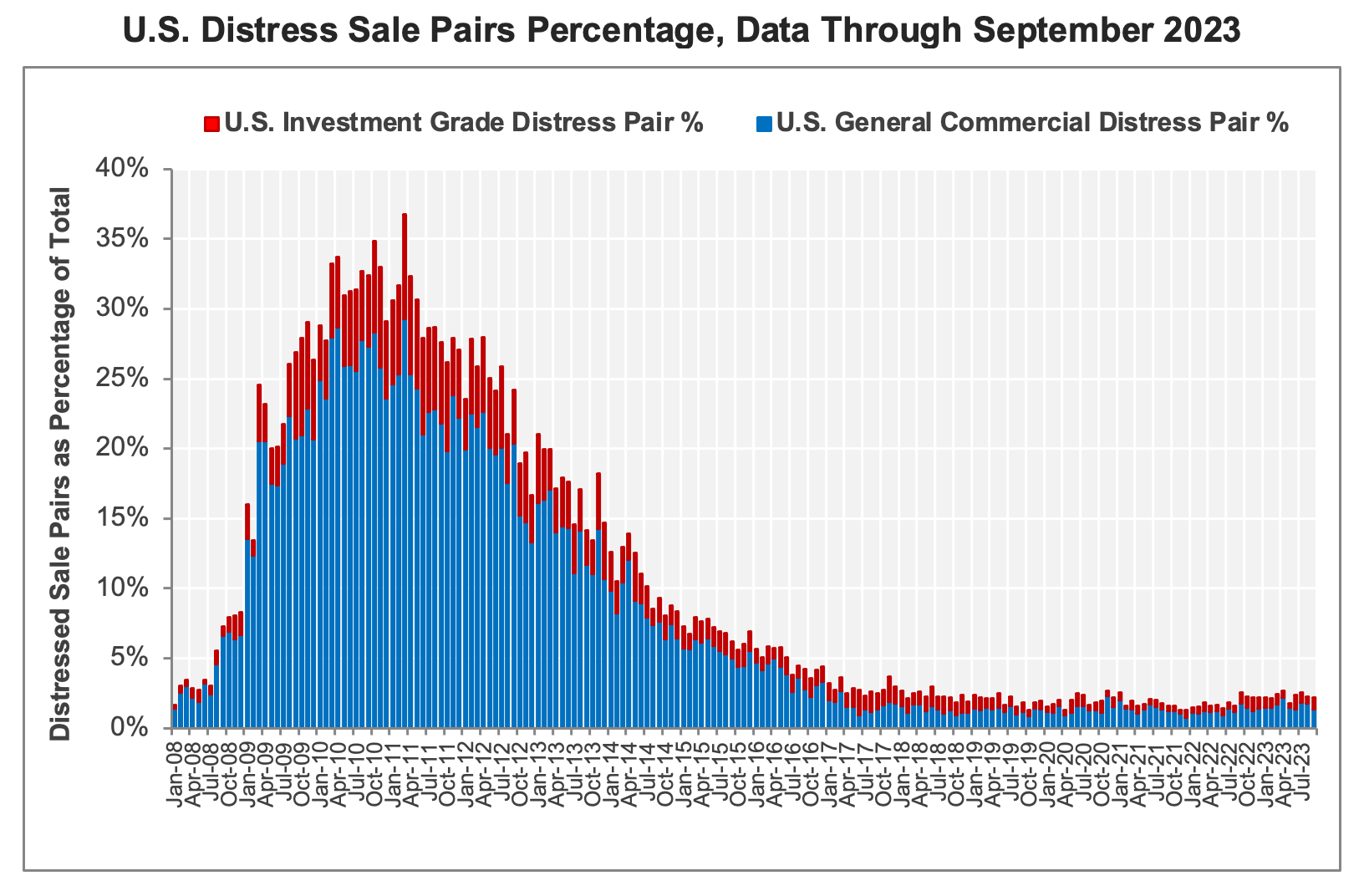

- BY HISTORICAL STANDARDS, DISTRESSED REPEAT SALES REMAIN LOW. Just 25 of the 1,132 repeat-sale trades in September 2023, or about 2.2%, were distressed sales. General commercial accounted for 15 of the distressed trades in September 2023, or 1.3% of all repeat sales trades. Ten investment-grade distressed sales were recorded in September 2023, accounting for 0.9% of all repeat sales trades.

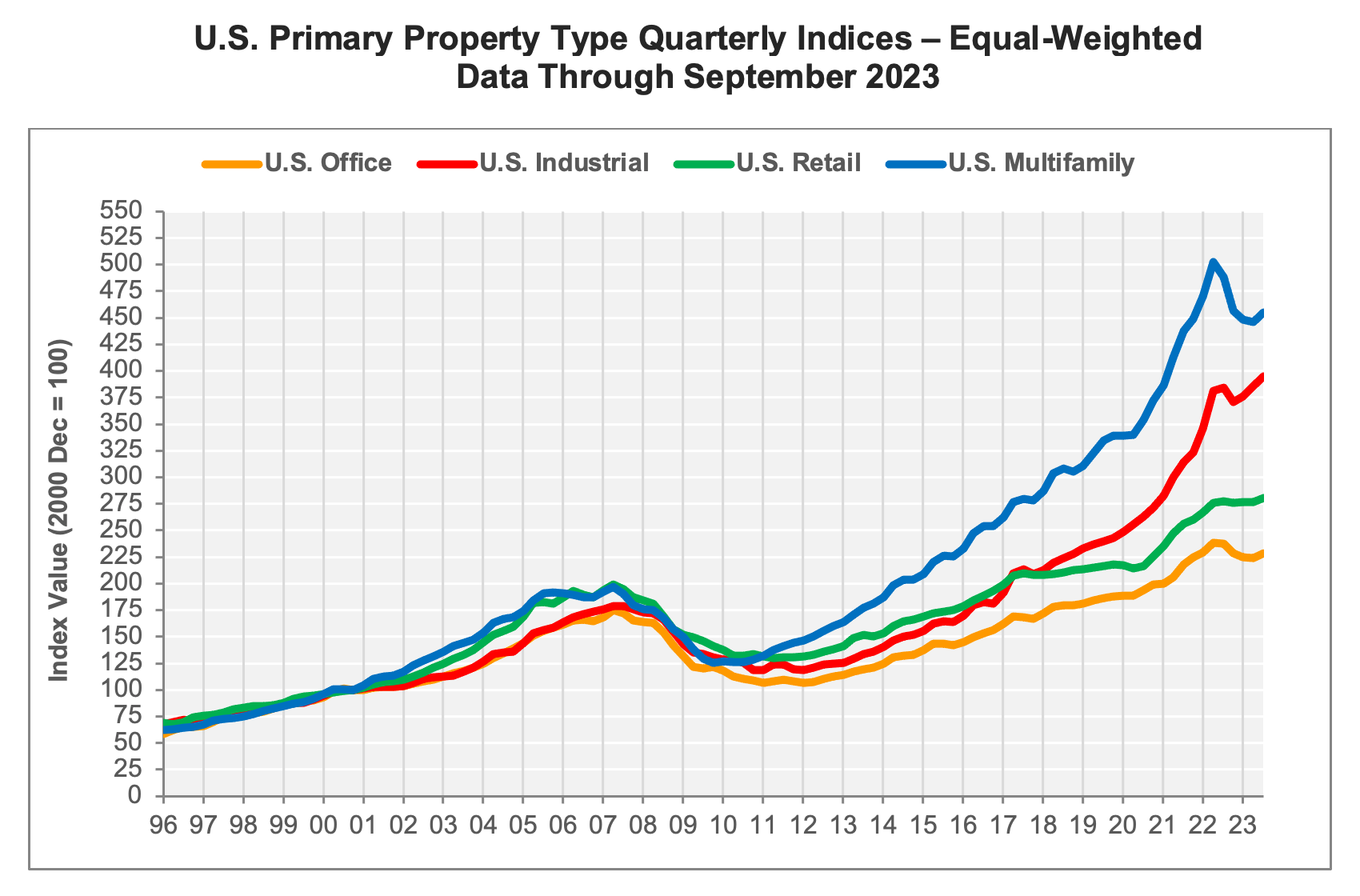

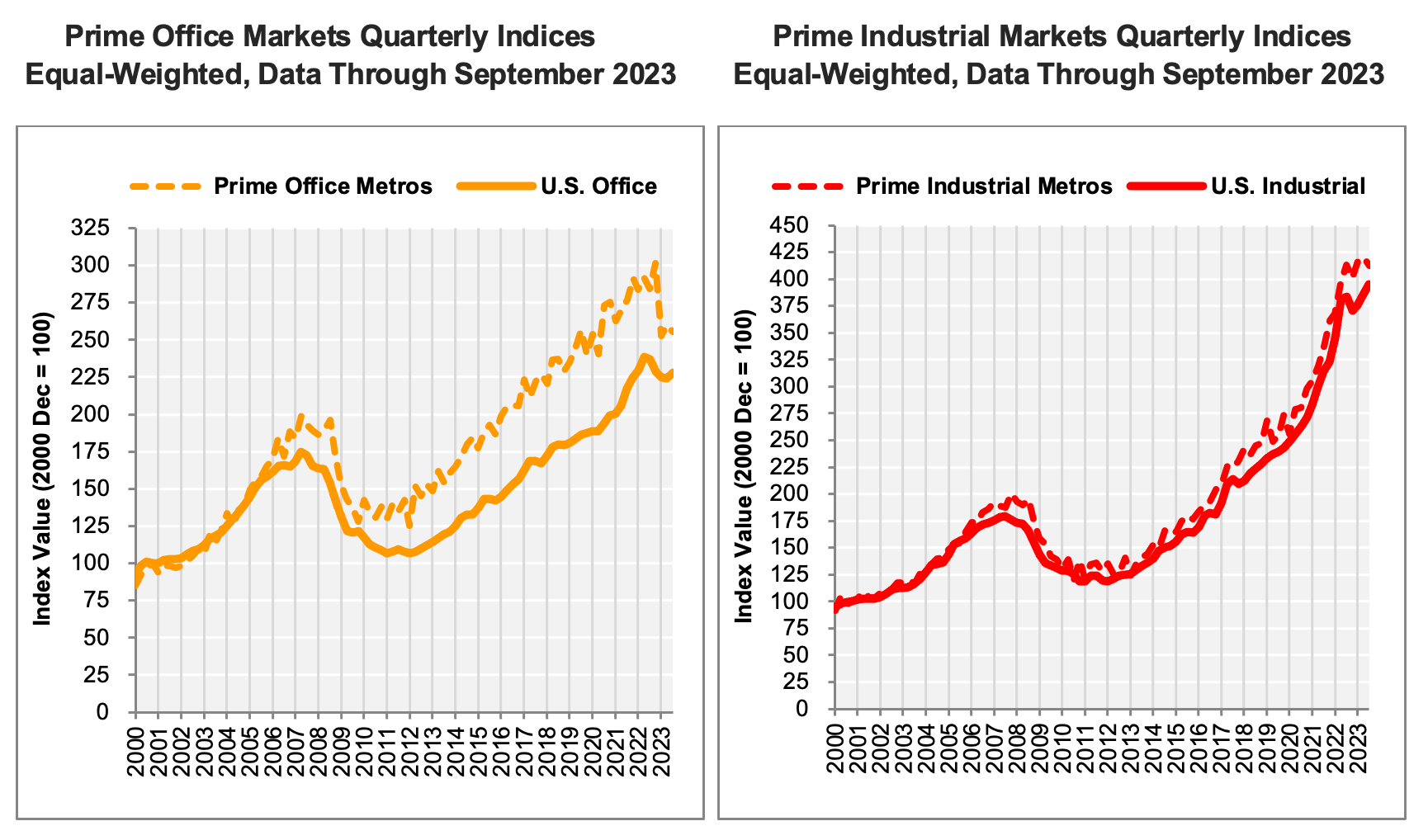

Quarterly CCRSI Property Type Results

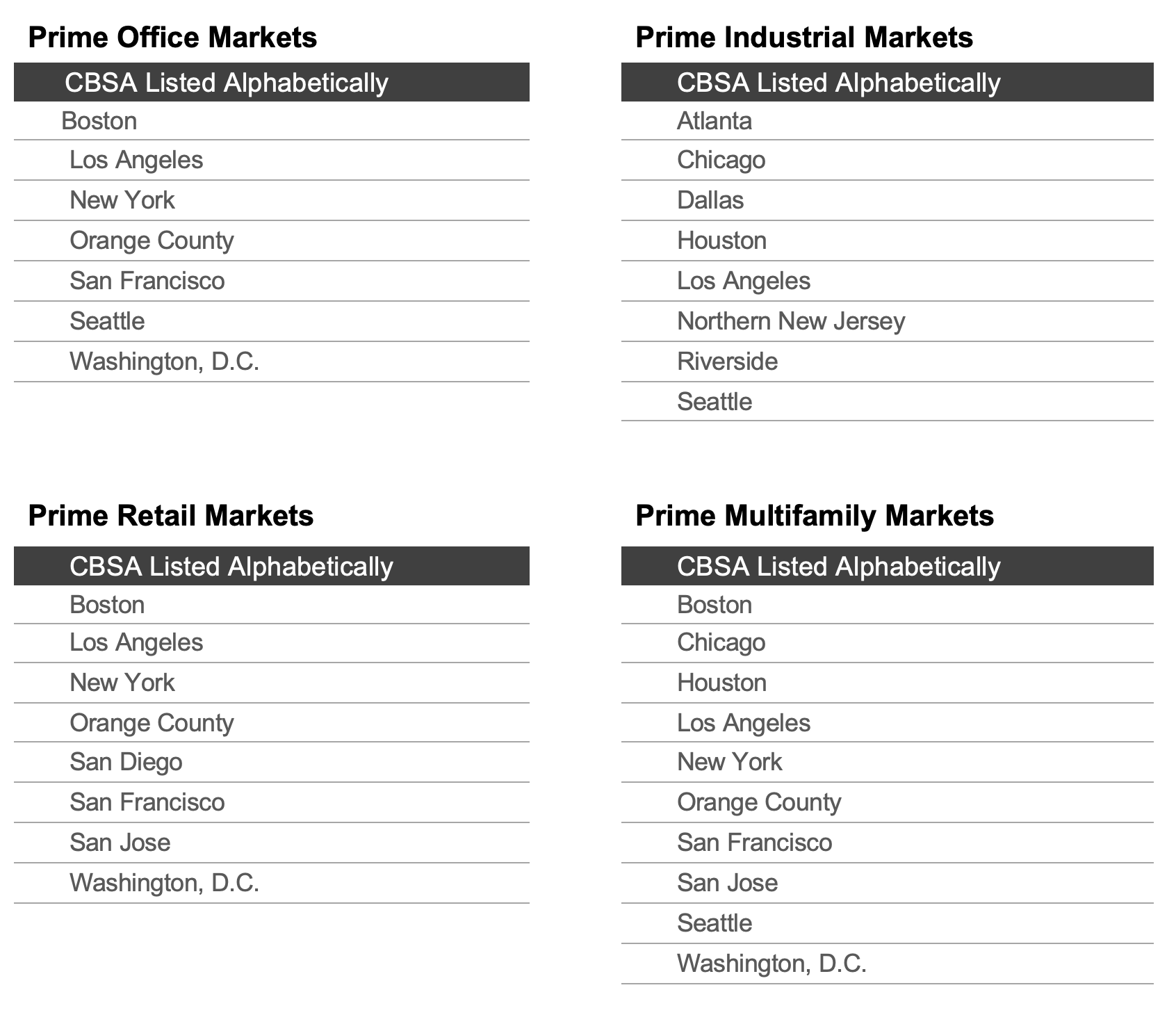

- EQUAL-WEIGHT PRICES GAINED IN THE THIRD QUARTER. Excluding land sales, the five main property types all saw positive equal-weighted price gains in the third quarter of 2023. However, the gains were not consistent across markets or property quality. The Prime Markets Indices within each property sector, which are dominated by the large, core, coastal metros, fell in unison during the 12-month period that ended in September 2023. For the first time since the first quarter of 2011, negative year-over-year price growth in prime markets confirms that commercial property price declines have become broad-based across property segments.

- INDUSTRIAL INDICES SHOWING MIXED GROWTH. The equal-weighted U.S. Industrial Index gained 2.4% over the prior quarter but logged its fourth consecutive quarter of declines in the value-weighted segment, which fell 0.9%. Compared to the third quarter of 2022, the value-weighted segment was 6.3% softer in the third quarter of 2023 despite the equal-weighted pricing surge, up 2.9% over the prior year. Prime Industrial Metros are moving in line with the U.S. value-weighted segment, edging 1.9% lower than the prior quarter and 0.3% below levels seen in the third quarter of 2022.

- MULTIFAMILY VALUES LEAPT HIGHER IN PRIMARY MARKETS. Prime Multifamily Metros saw a 2.3% increase in pricing compared to the second quarter of 2023. Prime Markets outperformed the U.S. Multifamily Index, which advanced by 2% over the prior quarter. The abundance of fixed-rate multifamily debt from agencies and bank lenders helped goose prices as the yields on benchmark rates moved sharply lower in the first half of 2023. The value-weighted U.S. Multifamily Index clawed back 90 basis points of value loss compared to the second quarter of 2023. Over the prior year, value-weighted Multifamily values dropped 15.7% compared to the third quarter of 2022.

- PRIME OFFICE CONTINUED TO STRUGGLE IN THE THIRD QUARTER. The U.S. Prime Office Index fell 1.6% in the third quarter of 2023 compared to the second quarter of 2023, taking its cumulative decline to negative 15.3% since the fourth quarter of 2022 and down 10% over the prior year. Equal-weighted Office Index pricing fared better in the third quarter of 2023, rising 1.9% over the previous quarter. Despite still being down by 3.8% from the third quarter of 2022, the equal-weight Office Index managed to reverse some of the losses seen in the second quarter of 2023.

- PRIME RETAIL PRICING PICKED UP AFTER THREE DOWN QUARTERS. The U.S. Prime Retail Index rose 2.3% in the third quarter after trending lower since the fourth quarter of 2022. The equal-weighted Retail Index also advanced 1.3% in the third quarter while gaining 1.1% since the third quarter of 2022. Like the other property types, the value-weighted Index showed pricing weakness and fell 0.4% during the third quarter. Pricing also dipped 2.4% among the higher-quality assets compared to the third quarter of 2022.

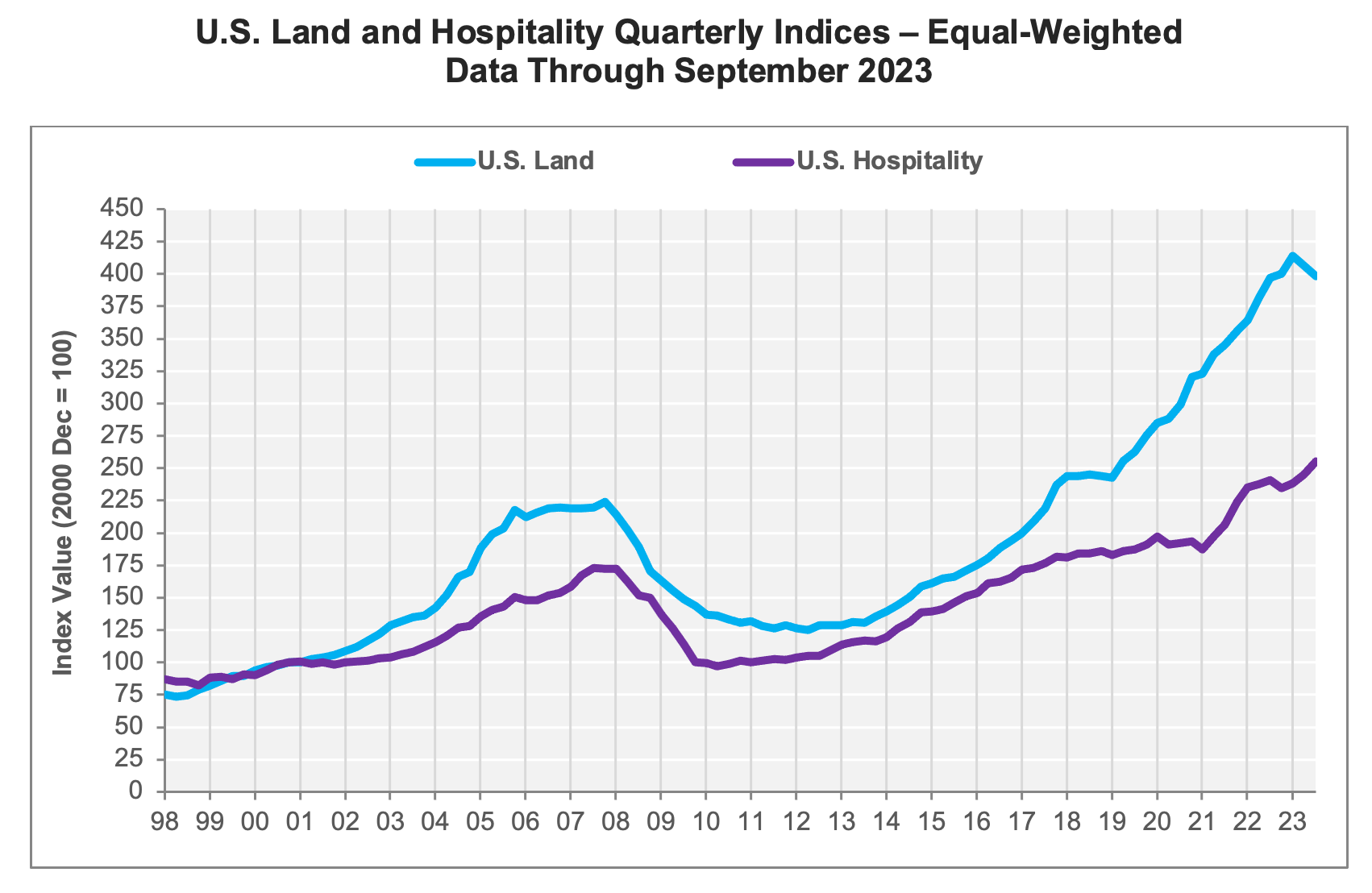

- U.S. HOSPITALITY INDEX MARCHED HIGHER. The U.S. Hospitality Index was up 4% in the third quarter of 2023, contributing to annual gains of 6% in the 12-month period ending in September 2023. The U.S. Hospitality Index was 33.6% above its pre-recession peak in the third quarter of 2023.

- THE U.S. LAND INDEX RESPONDED TO FALLING CONSTRUCTION STARTS. For the second quarter in a row, the U.S. Land Index declined, this time by 2% in the third quarter of 2023. Annual gains are also descending rapidly, going from a 12-month gain of 15.1% in the third quarter of 2022, to flat at just 0.2% in the third quarter of 2023.

Quarterly CCRSI Regional Results

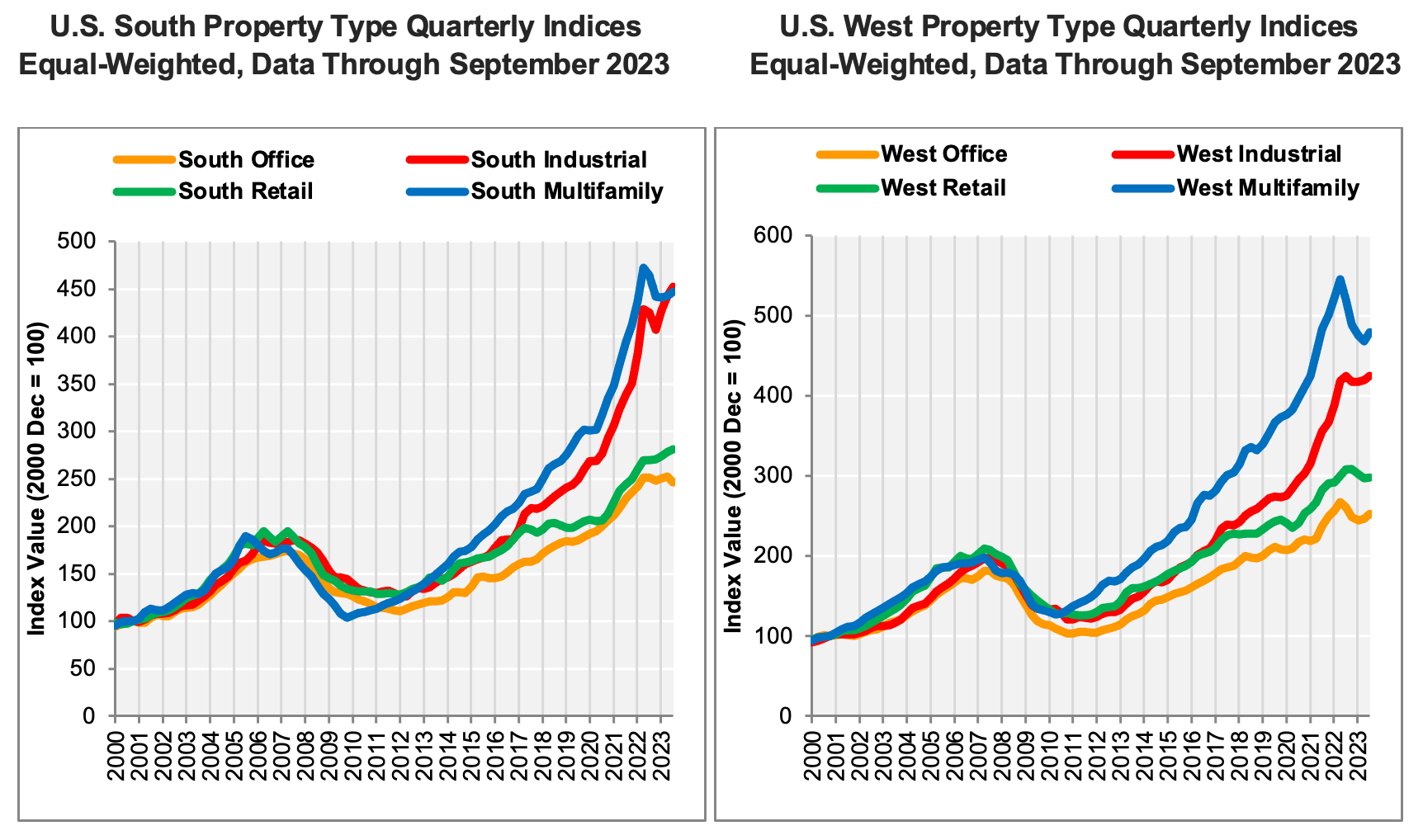

- INDUSTRIAL AND RETAIL LED ANNUAL PRICE GAINS IN THE SOUTH. The four property types within each of the four regions produce 16 total property-type regions. Out of 16 subcategories, 14 property-type regions showed flat or negative price changes in the third quarter of 2023 compared to the third quarter of 2022. The equal-weighted South Composite Index’s annual gains were led by industrial at 6.3% over the prior 12-month period ending in September 2023, while retail grew at 4.1%. The South Office Index fell 1.9% over the prior year, while multifamily sank 3.7% compared to the third quarter of 2022. When pitted against the prior quarter, however, industrial pricing expanded by 2.1%, and retail and multifamily each gained 1.1% in value. The South Office sector was alone in its descent at -2.4% price growth compared to the second quarter of 2023. In the aggregate, the equal-weighted South Composite region shuffled sideways, with a 0.2% gain over the prior quarter and a 0.5% loss over the prior year. The value-weighted South Composite Index, on the other hand, slid 2.2% over the prior quarter and 12.5% below the third quarter of 2022.

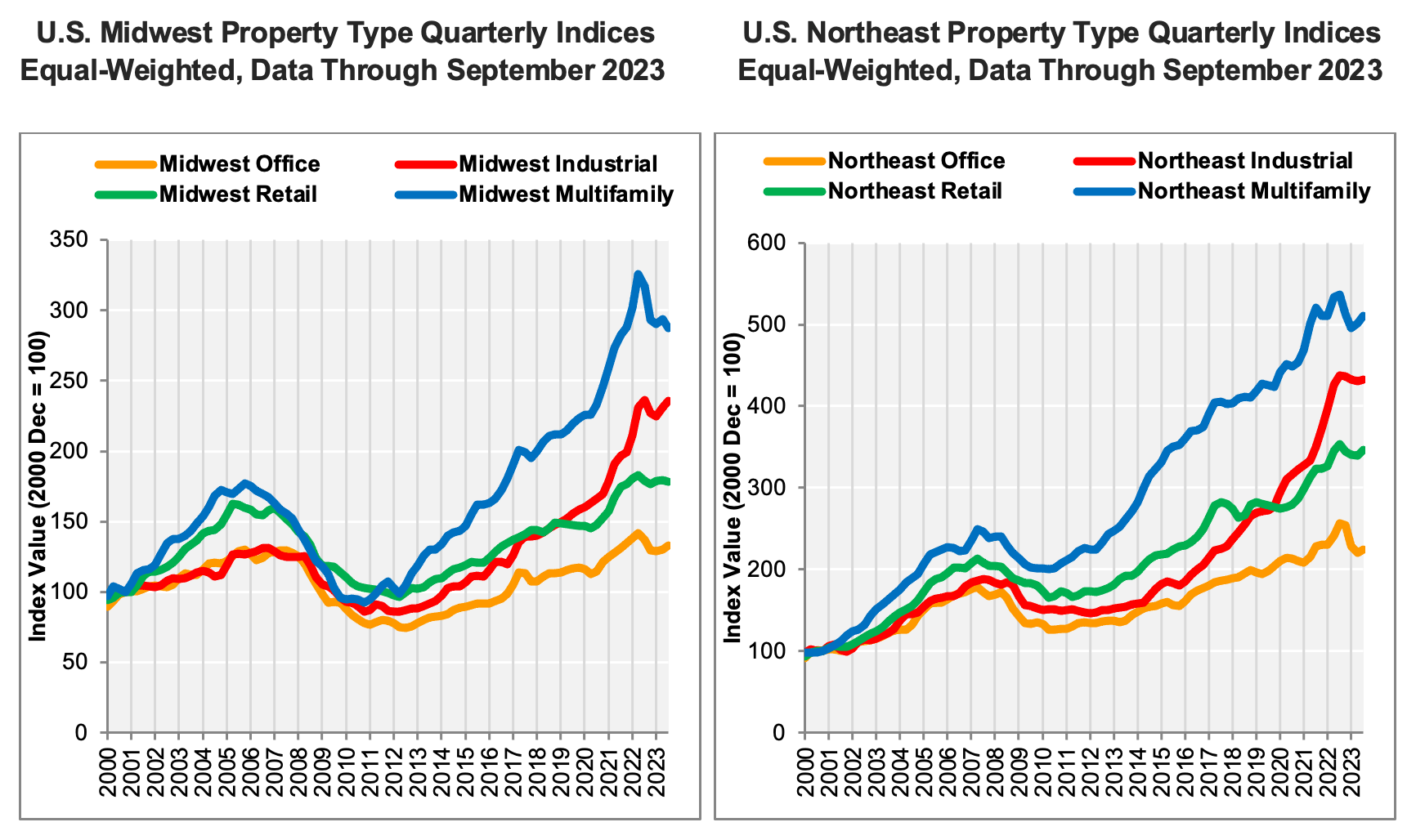

- NORTHEAST OFFICE FALLS UNDER PRESSURE. The equal-weighted Northeast Composite Index rose 1.8% in the third quarter of 2023 over the prior quarter, which helped offset annual losses, with the index falling 4.9% compared to the 12-month period ending in 2022. The value-weighted Northeast Composite Index fared better, posting a 1.9% gain over the prior quarter and a 5.1% upsurge over the third quarter of 2022. The equal-weighted Northeast Office Index stood out with a 12.6% decline in the 12-month period ending in September 2023, the worst-performing property-type region in the third quarter. All four property types fell in the third quarter compared to the year prior, with multifamily at -4.9%, retail at -2%, and industrial at -1.2%. Despite the long-term trend lower, the third quarter will be either a head-fake bounce or the beginning of a bottoming price formation. When juxtaposed against the second quarter of 2023, all four property types posted positive price growth, with retail and multifamily expanding by 1.8%, office rising 1.8%, and industrial footing 0.4% higher.

- OFFICE AND INDUSTRIAL GIRDED MIDWEST PRICE DECLINES. On an annual basis, the equal-weighted Midwest Composite Index fell 1.2%, while the quarterly performance shot 2.4% higher compared to the second quarter of 2023. All four property types displayed negative year-over-year price action compared to the third quarter of 2022. Measured against this time last year, the Midwest Multifamily Index tumbled 9.4%, Midwest Office fell 3.1%, Midwest Retail slid 0.4%, and Midwest Industrial stepped 0.1% lower. Conversely, the quarterly pricing increase seen in the industrial and office segments provided an optimistic increase. The Midwest Industrial Index added another 2.1% to last quarter’s 2.9% growth, while the Midwest Office segment rose by 1.9% in the third quarter of 2023. Midwest Retail lost 0.7% of its value and performed better than the Midwest Multifamily segment, which fell 2.2% in the quarter.

- INDUSTRIAL AND RETAIL LED ANNUAL PRICE GAINS IN THE SOUTH. The four property types within each of the four regions produce 16 total property-type regions. Out of 16 subcategories, 14 property-type regions showed flat or negative price changes compared to the third quarter of 2022. The equal-weighted South Composite Index’s annual gains were led by industrial at 6.3% over the prior 12-month period, while retail grew at 4.1%. The South Office Index fell 1.9% over the prior year, while multifamily sank 3.7% compared to the third quarter of 2022. When pitted against the prior quarter, however, industrial pricing expanded by 2.1%, and retail and multifamily each gained 1.1% in value. The South Office sector was alone in its descent at negative 2.4% price growth compared to the second quarter of 2023. In the aggregate, the equal-weighted South Composite region shuffled sideways, with a 0.2% gain over the prior quarter and a 0.5% loss over the prior year. The value-weighted South Composite Index, on the other hand, slid 2.2% over the prior quarter and 12.5% below the third quarter of 2022.

- PRICING TRENDED LOWER IN THE WEST. Among the equal-weighted West Composite Indices, the quarterly price decline was negligible, with a 0.1% loss, at the same time giving up 0.9% over the prior year. Quarter-over-quarter pricing in the value-weighted Index swung 2.2% higher in the third quarter of 2023 and helped limit the 8.9% value erosion experienced since the third quarter of 2022. After several quarters of price declines, the West Multifamily segment popped 2.2% higher over the prior quarter, but it was not enough to offset the 7.8% loss when compared to the third quarter of 2022. The West’s Office and Retail segments both gave back 3.3% of value over the 12-month period ending in September 2023 while showing positive performance over the prior quarter. The West Office segment managed to spike 2.3% higher in the third quarter, while the West Retail sector footed 0.3% above the second quarter of 2023. The West Industrial Index was flat over the trailing 12-month period, with a 1.2% gain compared to the second quarter of 2023.

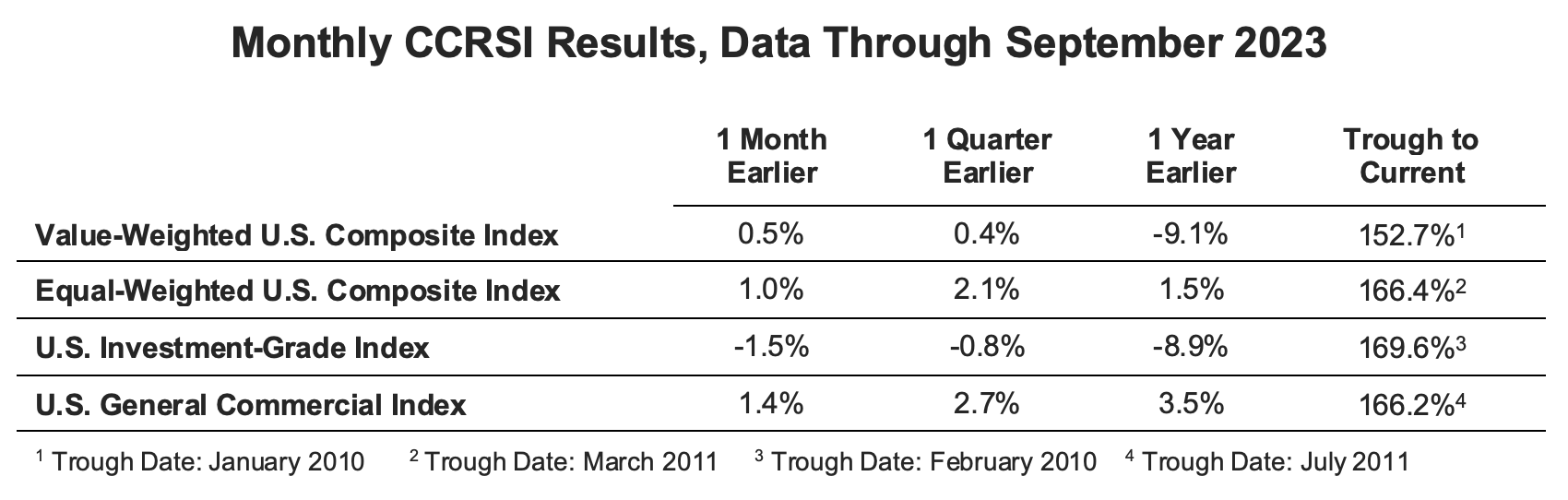

About The CoStar Commercial Repeat-Sale Indices

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which are reported monthly, 30 sub-indices in the CoStar index family are reported quarterly. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country). The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all the sales pairs are used to create a price index. Historical price indices are revised as new data is recorded.

MEDIA CONTACT:

Matthew Blocher, Vice President, Marketing & Communications, CoStar Group (mblocher@costar.com).

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices, and disclaimer, please visit https://costargroup.com/costar-news/ccrsi/.

ABOUT COSTAR GROUP, INC.

CoStar Group, Inc. (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret, and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. Realla is the UK’s most comprehensive commercial property digital marketplace. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time we plan to utilize our corporate website, www.costargroup.com, as a channel of distribution for material company information. For more information, visit www.CoStarGroup.com