Prices Decelerate in October 2022 for the Fourth Consecutive Month as Investor Interest Wanes

CCRSI RELEASE – November 2022

(With data through October 2022)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through October 2022. Based on 1,303 sale pairs in October 2022 and almost 282,000 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

-

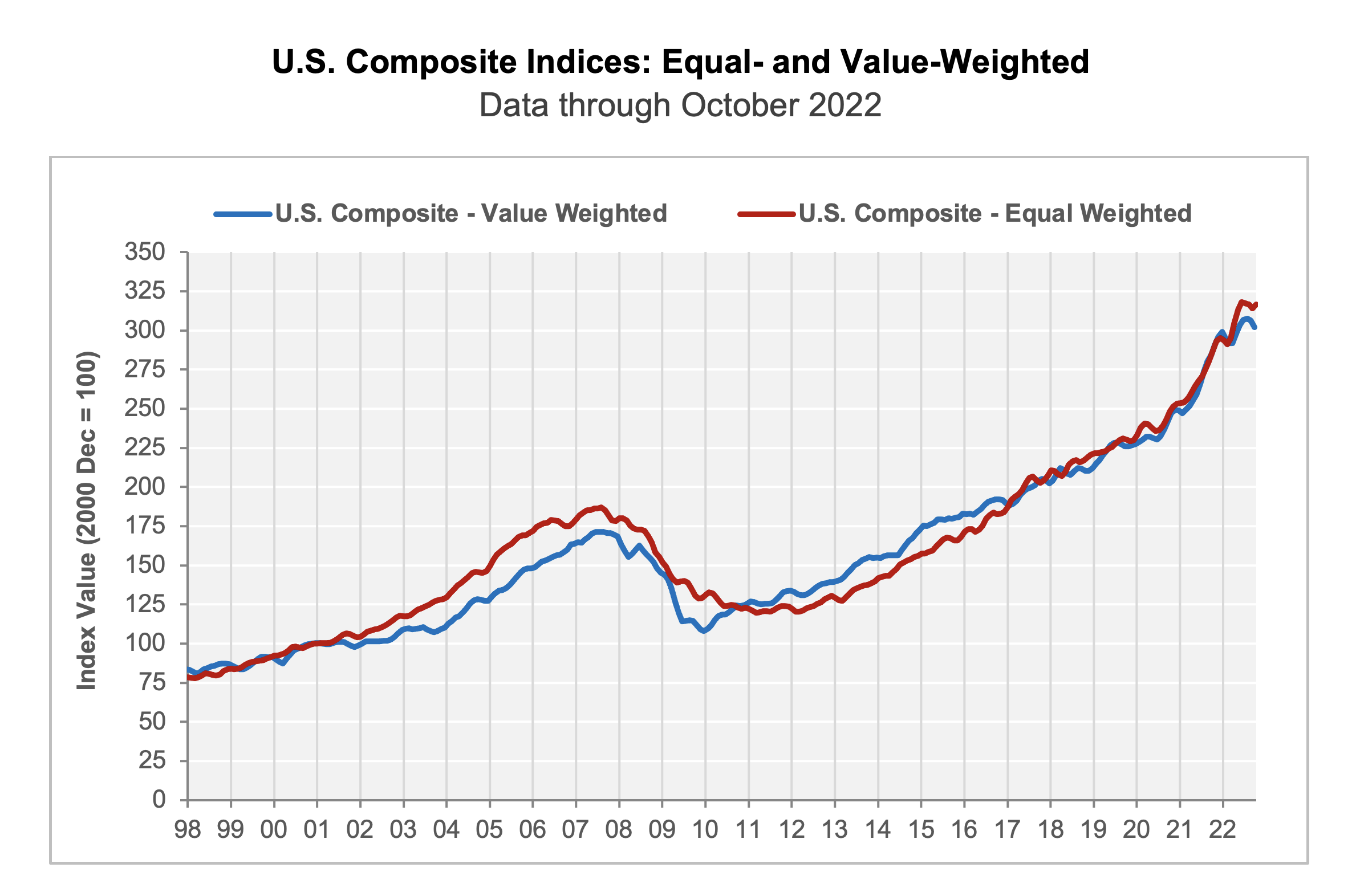

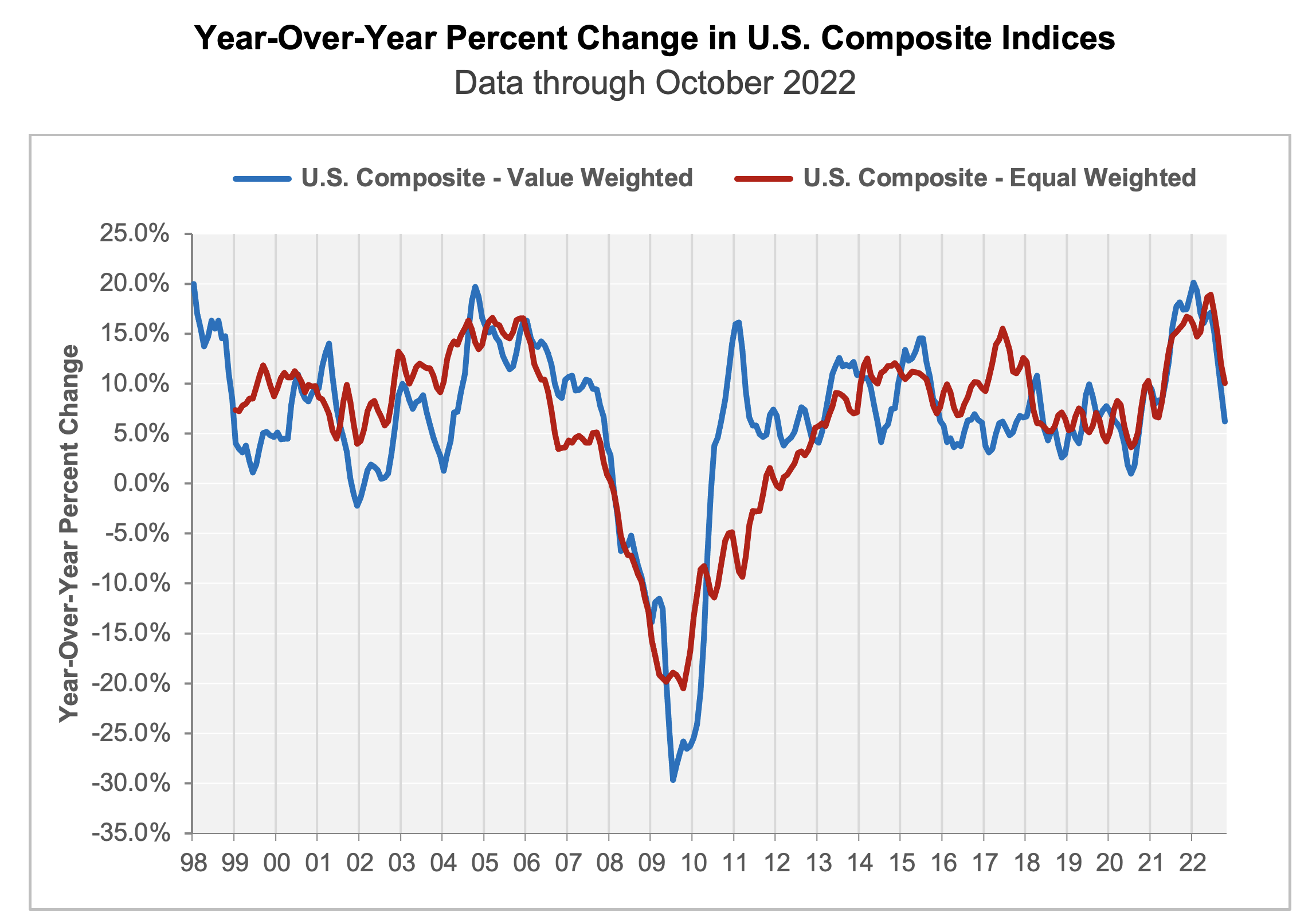

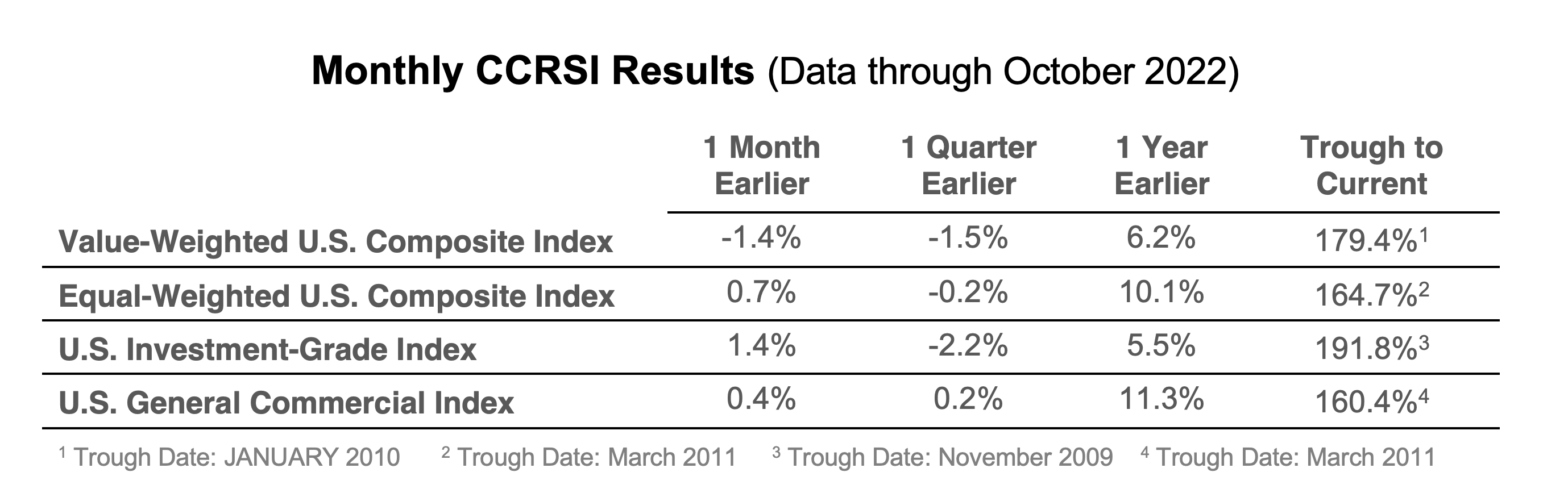

U.S. COMPOSITE PRICE INDICES DIVERGED IN OCTOBER 2022. The value-weighted U.S. Composite Index, which is more heavily influenced by high-value trades common in core markets, fell for the second month in a row to 302, a fall of 1.4% over the prior month. The index was up by 6.2% in the 12-month period that ended in October 2022 and is 48.2% higher than in February 2020, before the onset of the COVID-19 pandemic.

-

Meanwhile, the equal-weighted U.S. composite index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, rose three points to 317 in October 2022, an increase of 0.7% over the prior month after three consecutive months of declines. The index gained 10.1% in the 12-month period that ended in October 2022 and is 33% above its February 2020 pre-pandemic level.

-

Both composite indices have been on a broad deceleration trend in year-over-year growth for the last four consecutive months as markets respond to an environment of higher interest rates as the Federal Reserve battles decades-high inflation.

-

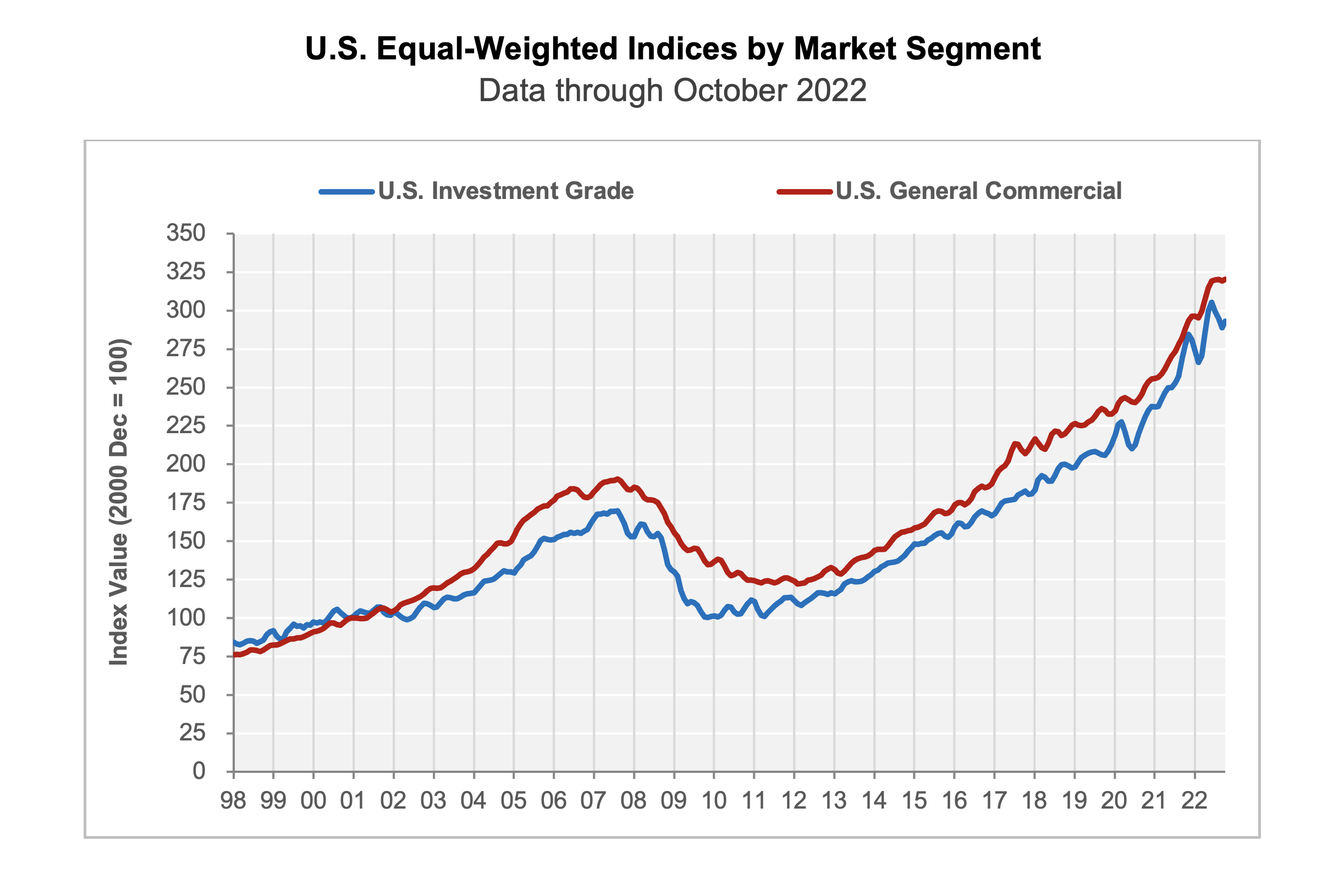

BOTH MARKET SEGMENTS OF THE EQUAL-WEIGHTED COMPOSITE PRICE INDEX GAINED IN OCTOBER 2022.

-

The investment grade sub-index, more heavily influenced by higher-value assets, rose by 1.4% in October 2022, its first gain in four consecutive months and almost reversing the prior month’s decline. The index saw price growth of 5.5% over the 12-month period that ended in October 2022, its smallest 12-month gain since February 2021.

-

The general commercial sub-index, more heavily influenced by smaller, lower-priced assets, rose by 0.4% in October 2022, more than reversing its prior month’s fall and reaching its historical rise. This index gained 11.3% over the 12-month period that ended in October 2022, its smallest 12-month gain since May 2021.

-

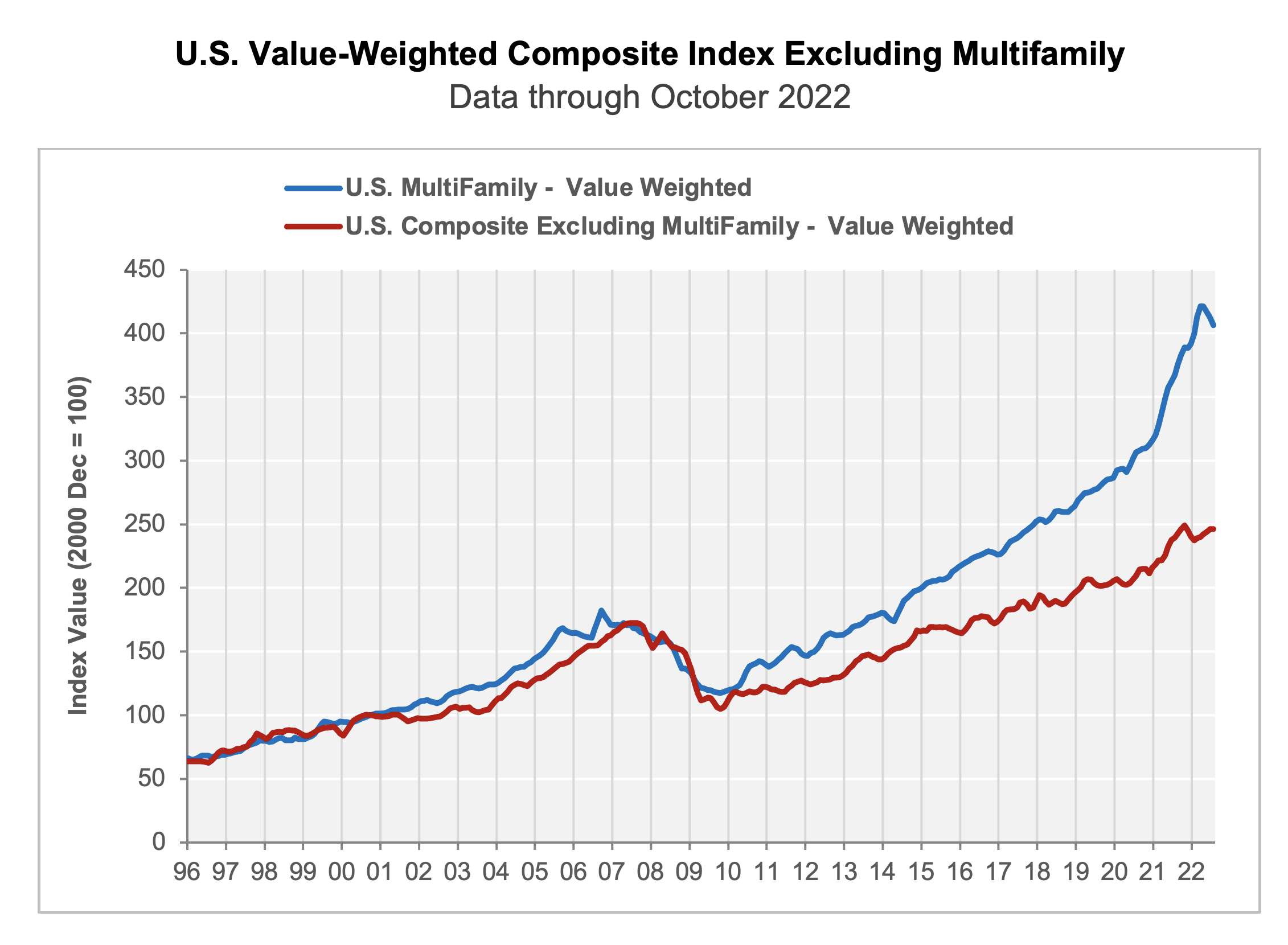

THE MULTIFAMILY SECTOR DROVE MOST OF THE PRICE GAINS IN THE VALUE-WEIGHTED INDEX OVER THE PAST DECADE. However, that sub-index has fallen in the past three consecutive months.

-

The multifamily sector sub-index fell by 1.4% in October 2022, its third month of decline since reaching a peak of 421 in June 2022. The index saw price growth of 10.5% in the 12-month period that ended in October 2022 and is 42.2% higher than in February 2020, before the onset of the pandemic. Net absorption in multifamily units reached historic highs in 2021 in response to pandemic-era impacts on the housing market, motivating double-digit annual price gains and making the sector an attractive asset class. Affordability destruction has tempered absorption more recently.

-

The value-weighted composite index excluding the multifamily sector edged only 0.1% higher in October 2022. The index gained 2.8% in the 12-month period that ended in October 2022 and is 21.1% higher than it was in February 2020, gaining less than half the rate that the multifamily gained during that same time period.

-

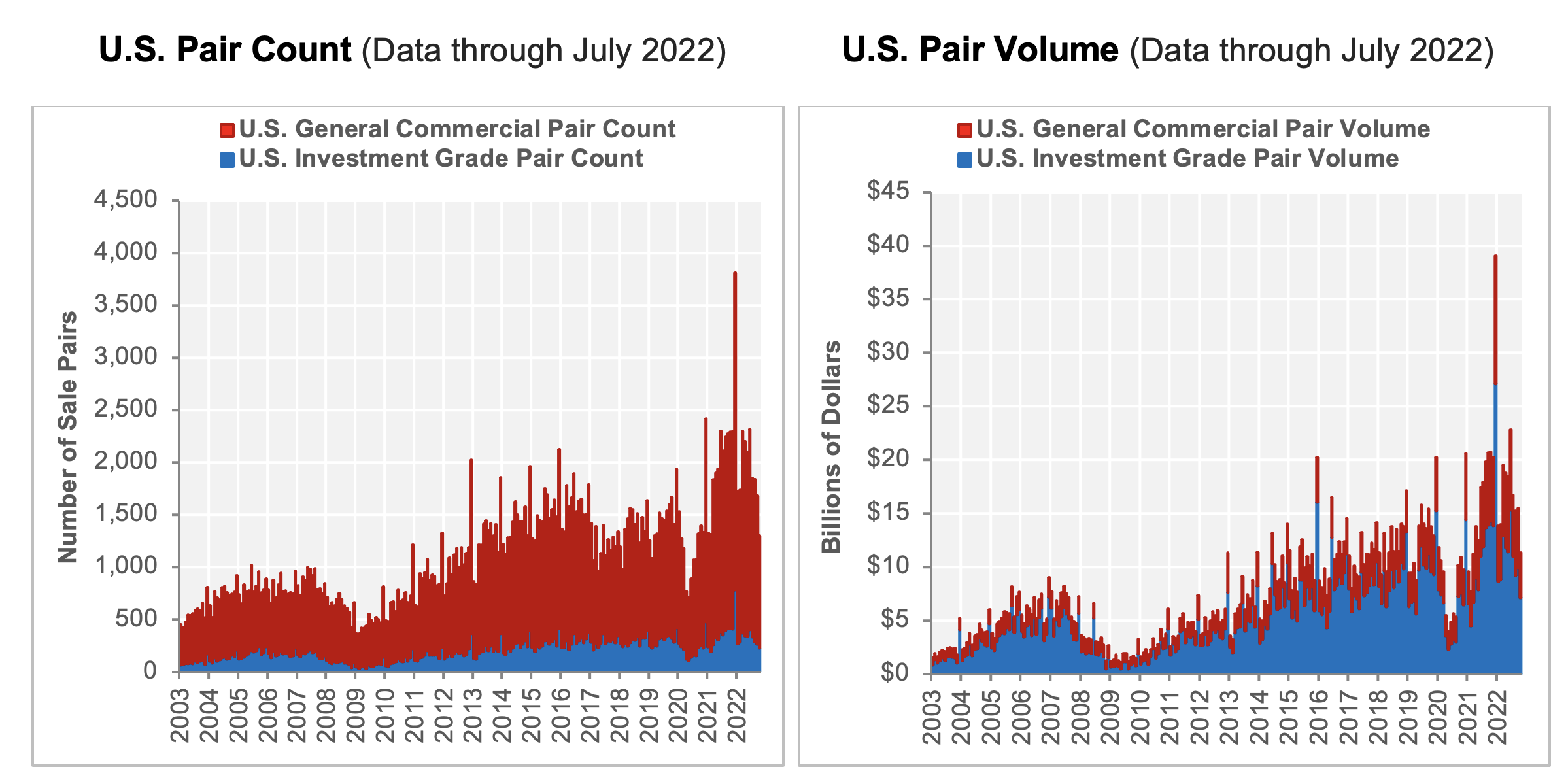

TRANSACTION VOLUME FELL IN OCTOBER 2022, REACHING ITS LOWEST LEVEL SINCE MARCH 2021. Transaction activity fell in October 2022 to $11.3 billion, a 26.7% decline from the prior month’s volume. Investment grade segment transaction volume pulled back in October 2022 by 28.1% to $7.1 billion while the general commercial segment fell by 24.3% compared to September 2022 to $4.2 billion.

-

Composite pair volume of $225.5 billion in the 12-month period ending in October 2022 was 24.1% higher than the 12-month period that ended in October 2021 due to unprecedented transaction activity in December 2021. The increase in volume was larger in the general commercial segment, which gained 27.6% over the 12 months that ended in October 2022 and accounted for less than one-third of the overall annual transaction volume. The investment grade segment, which accounted for almost two-thirds of the 12-month transaction volume, rose by 22.4% over the 12-month period ending in October 2022.

-

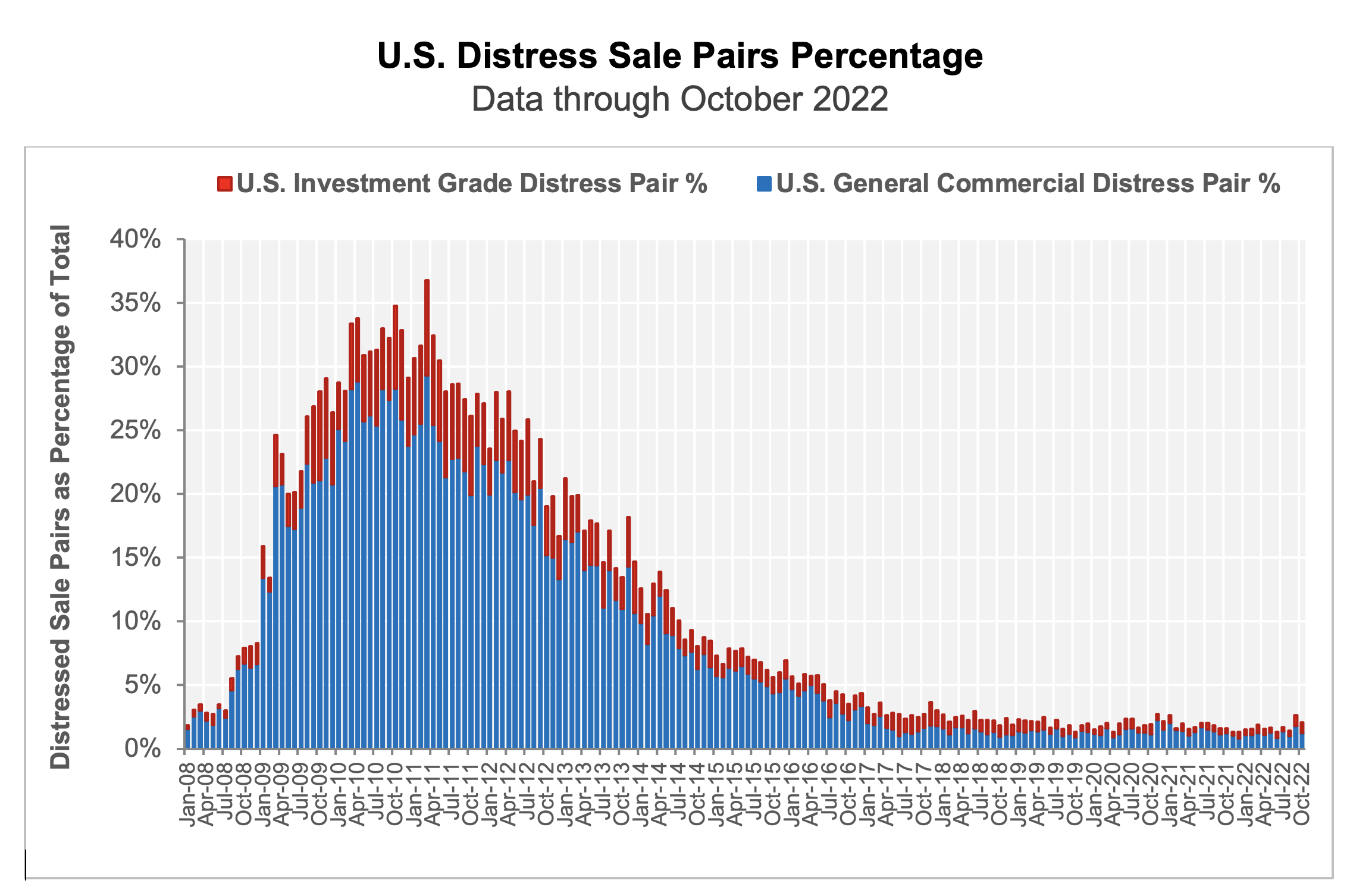

THE SHARE OF REPEAT-SALE TRADES THAT WERE DISTRESSED REMAINS LOW. Only 27 of the 1,303 repeat-sales trades in October 2022, or about 2.1%, were distressed sales. In comparison, the five-year pre-pandemic average share of distressed sales was 2.8%. General commercial distressed sales accounted for 16 of the distressed trades in October 2022, or 1.2% of all repeat-sales trades, below its five-year pre-pandemic average of 1.9%. Only eleven investment grade distressed sales were recorded in the month, accounting for 0.8% of all repeat sales trades, below its five-year pre-pandemic average of 1.0%.

-

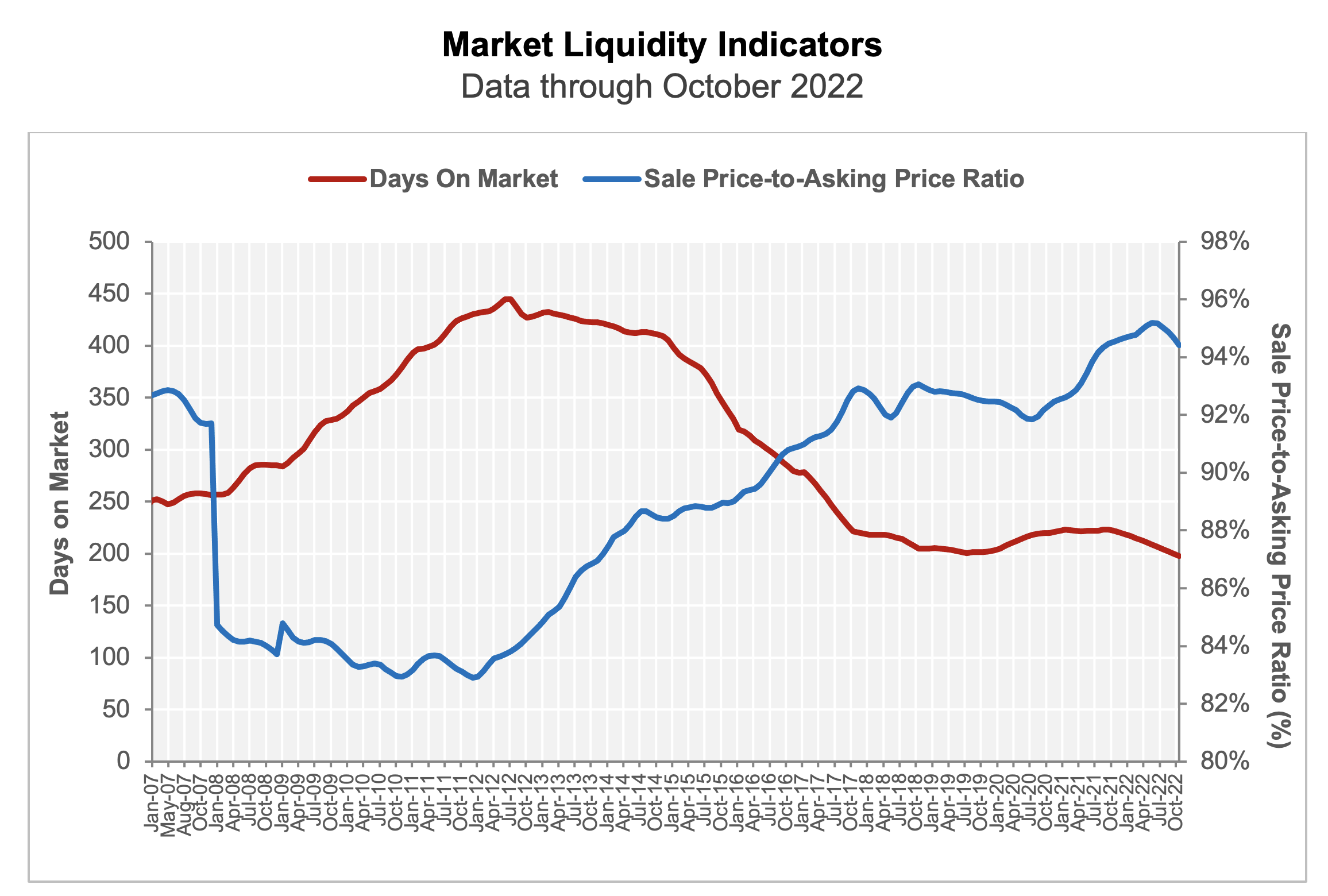

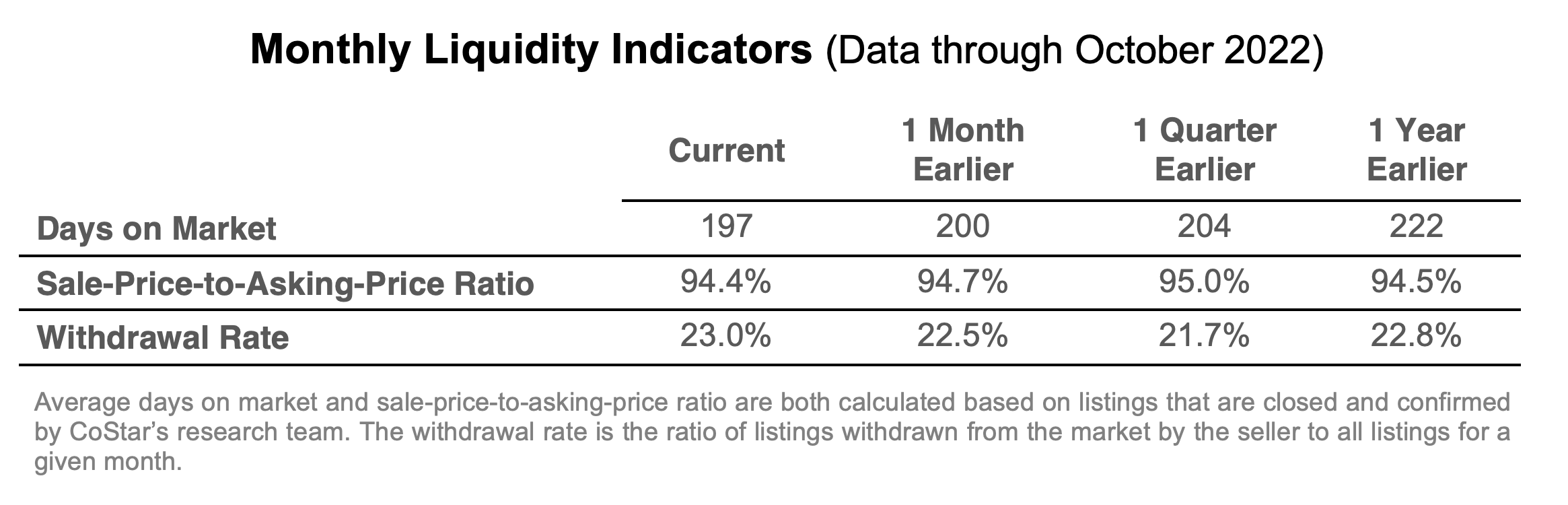

LIQUIDITY MEASURES POINT TO CONTINUED YET COOLING DEMAND. The average number of days on the market for for-sale properties fell for its 15th consecutive month to 197.3 days in October 2022 a fall of 0.3% over the prior month and the lowest it has been since January 2020. Meanwhile, the sale-price-to-asking-price ratio retreated by 0.3 percentage points to 94.4% in October 2022 but remains near the historical high reached in May 2022, suggesting a still competitive buying market.

-

However, the share of properties withdrawn from the market by discouraged sellers has been increasing since June 2022 and rose by 0.5 percentage points to 23% in October 2022. This indicator fell consistently from July 2020 through May 2022 but appeared to deteriorate as the spread between buyers’ and sellers’ price expectations widens. Still near the historical lows reached in May of 2022, the indicator suggested that sellers were mostly achieving their sales targets.

About The CoStar Commercial Repeat-Sale Indices

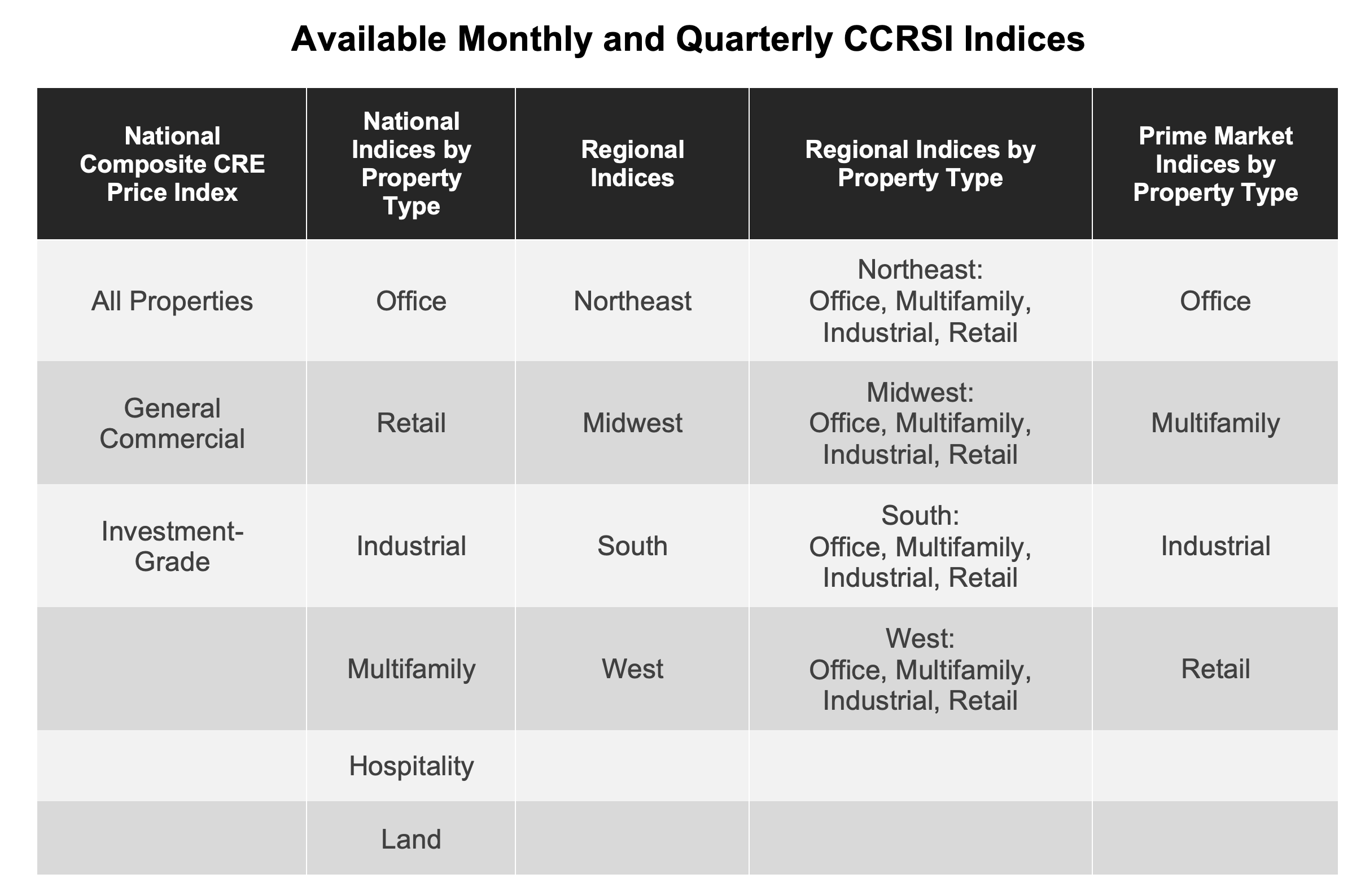

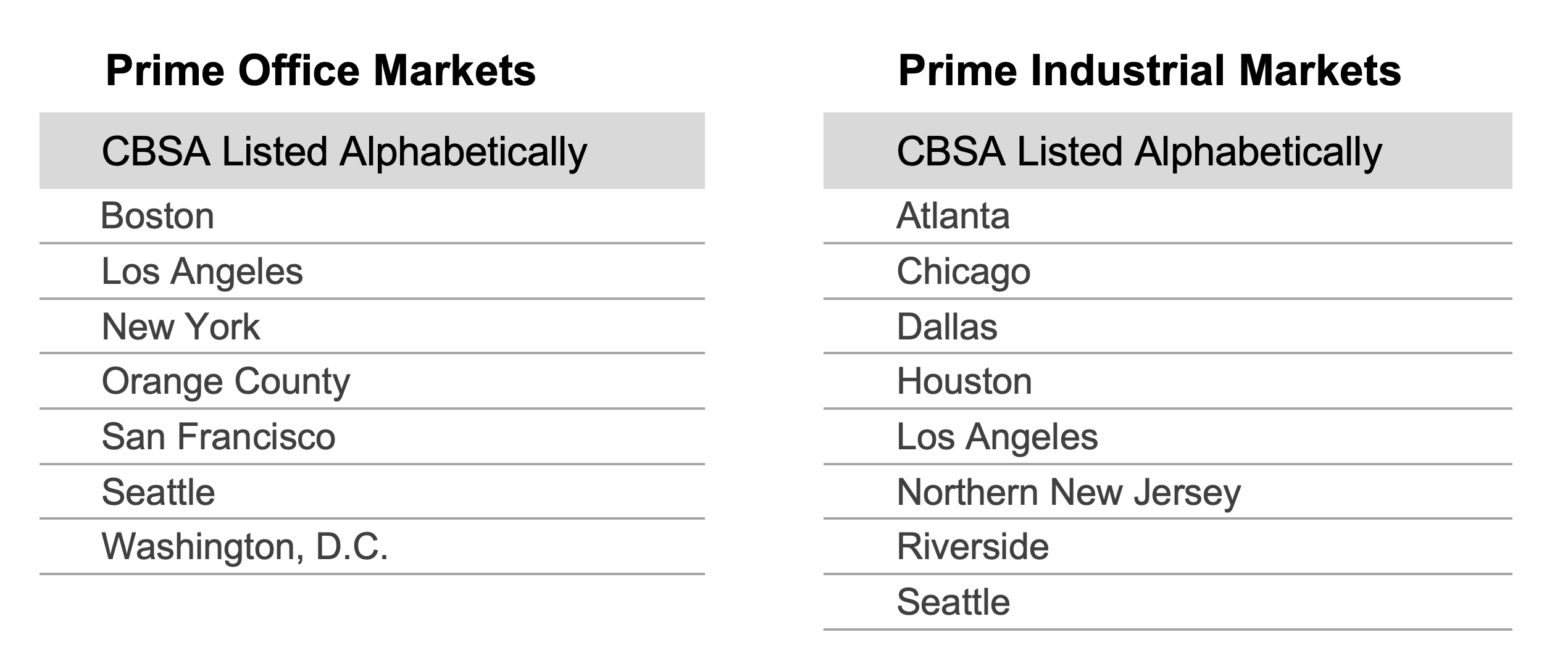

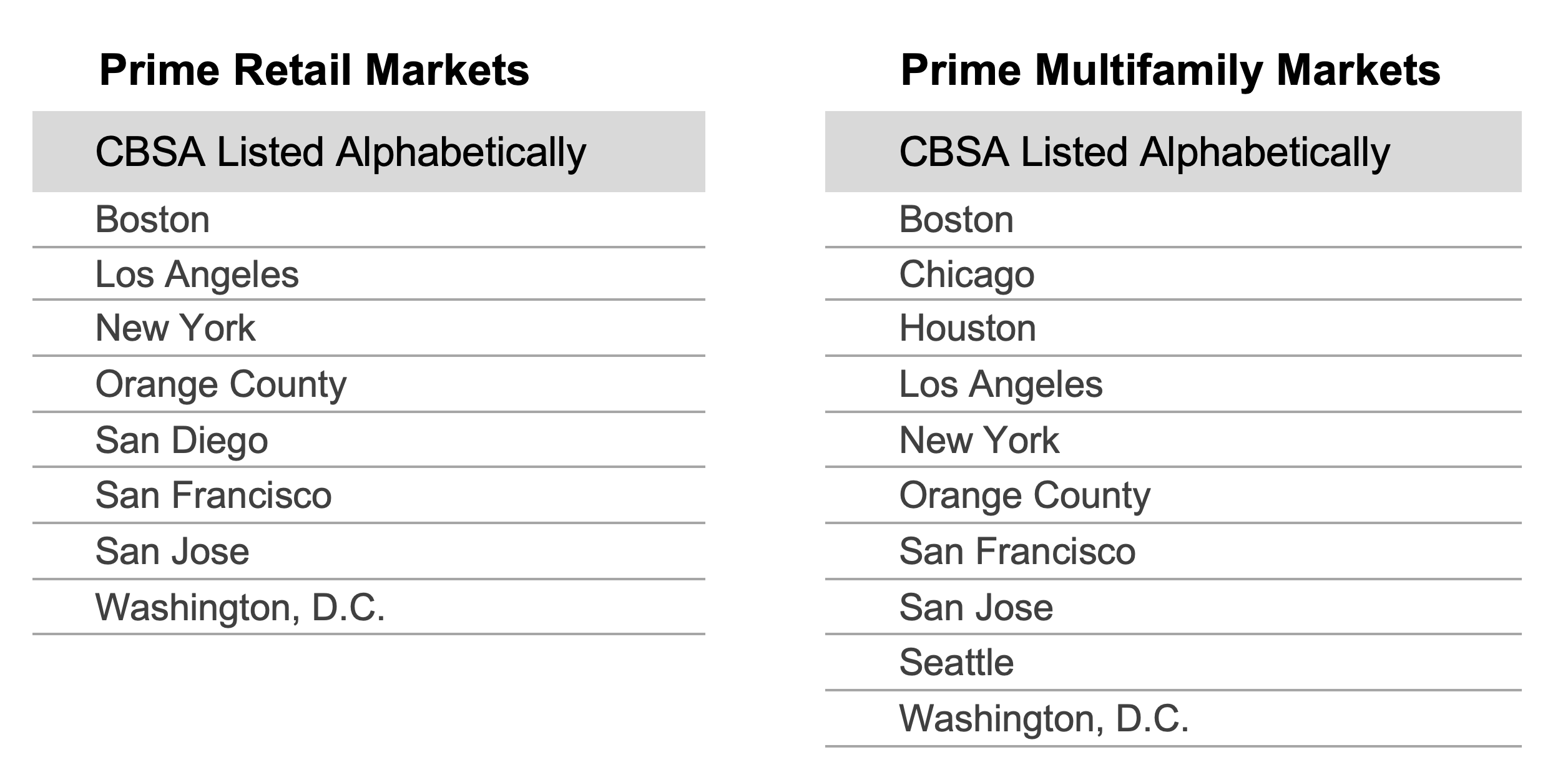

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which are reported monthly, 30 sub-indices in the CoStar index family are reported quarterly. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country).

The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all the sales pairs are used to create a price index. Historical price indices are revised as new data is recorded.

CONTACT:

Matthew Blocher, Vice President, Marketing & Communications, CoStar Group (mblocher@costar.com).

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices, and disclaimer, please visit http://costargroup.com/costar-news/ccrsi.

ABOUT COSTAR GROUP, INC.

CoStar Group, Inc. (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret, and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. Realla is the UK’s most comprehensive commercial property digital marketplace. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time we plan to utilize our corporate website, www.costargroup.com, as a channel of distribution for material company information. For more information, visit www.CoStarGroup.com.