After Peaking In Summer 2022, Prices Continued To Fall In January 2023 As Higher Interest Rates Affect Lending Markets

CCRSI RELEASE – February 2023

(With data through January 2023)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through January 2023. Based on 1,032 repeat sale pairs in January 2023 and 286,595 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

-

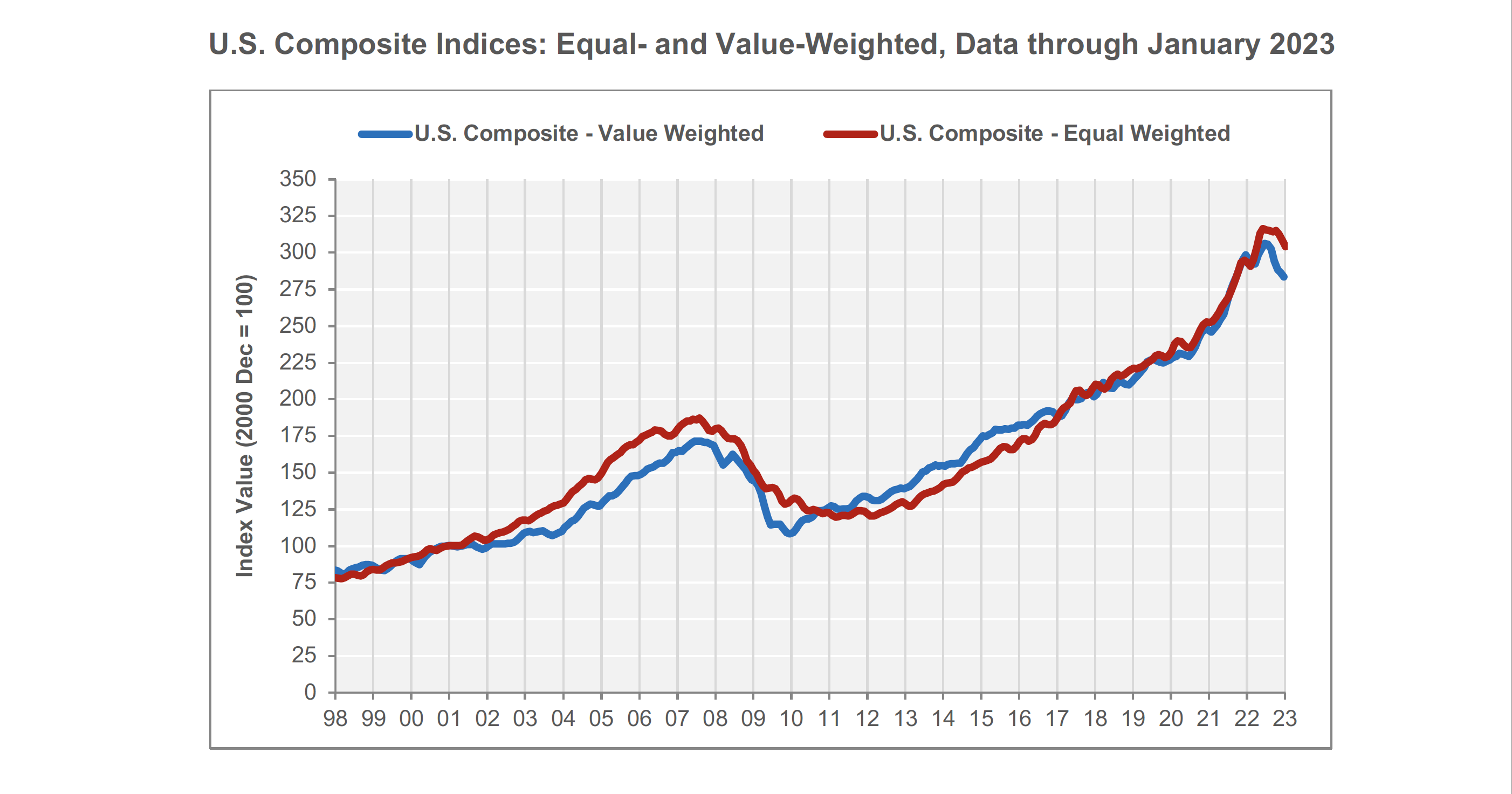

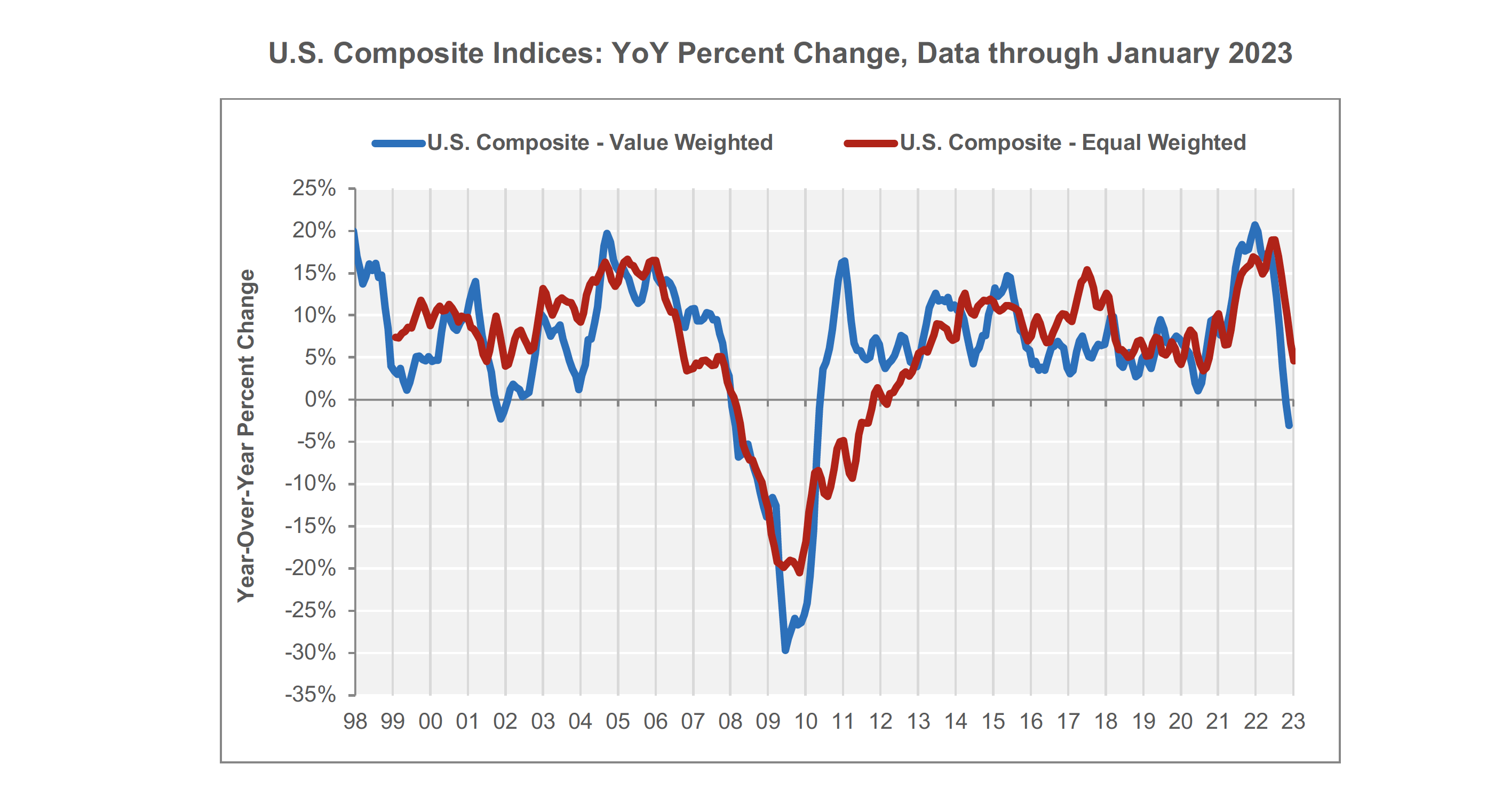

U.S. COMPOSITE PRICE INDICES DECLINED IN JANUARY 2023. The value-weighted U.S. Composite Index, which is more heavily influenced by high-value trades common in core markets, fell for the sixth consecutive month to 283, a fall of 1% over the prior month. The index was down 5.1% in the 12-month period that ended in January 2023 and is 24.2% higher than in February 2020, before the onset of the COVID-19 pandemic.

-

At the same time, the equal-weighted U.S. composite index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, retreated four points to 304 in January 2023, a decline of 1.3% over the prior month after falling in six of the last seven months. The index gained 3.8% in the 12-month period that ended in January 2023 and is 28% above its February 2020 pre-pandemic level.

-

Both composite indices have been on a broad deceleration trend in year-over-year growth for the last seven consecutive months as markets respond to an environment of higher interest rates as the Federal Reserve battles decades-high inflation.

-

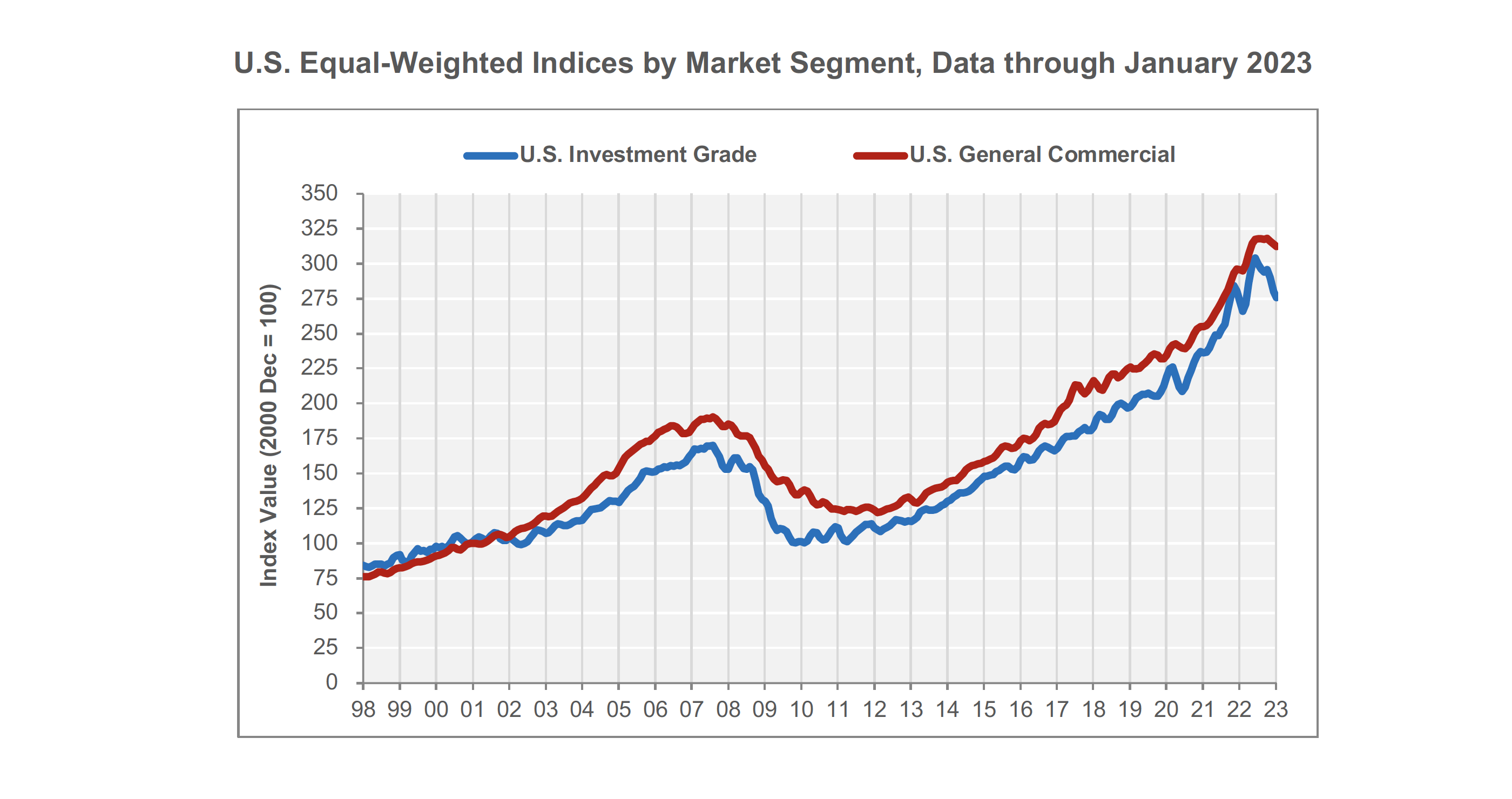

BOTH MARKET SEGMENTS OF THE EQUAL-WEIGHTED COMPOSITE PRICE INDEX FELL IN JANUARY 2023.

-

The investment grade sub-index, more heavily influenced by higher-value assets, declined by 1.4% in January 2023, slipping in six of the last seven months. The index saw price growth of 0.9% over the 12-month period ending in January 2023, on par with the annual gain experienced in June 2020 and the second-lowest annual gain since then.

-

The general commercial sub-index, more heavily influenced by smaller, lower-priced assets, gave back 0.7% in January 2023, the fourth such fall in the last five months. This index gained 5.5% over the 12-month period that ended in January 2023, its smallest 12-month gain since September 2020.

-

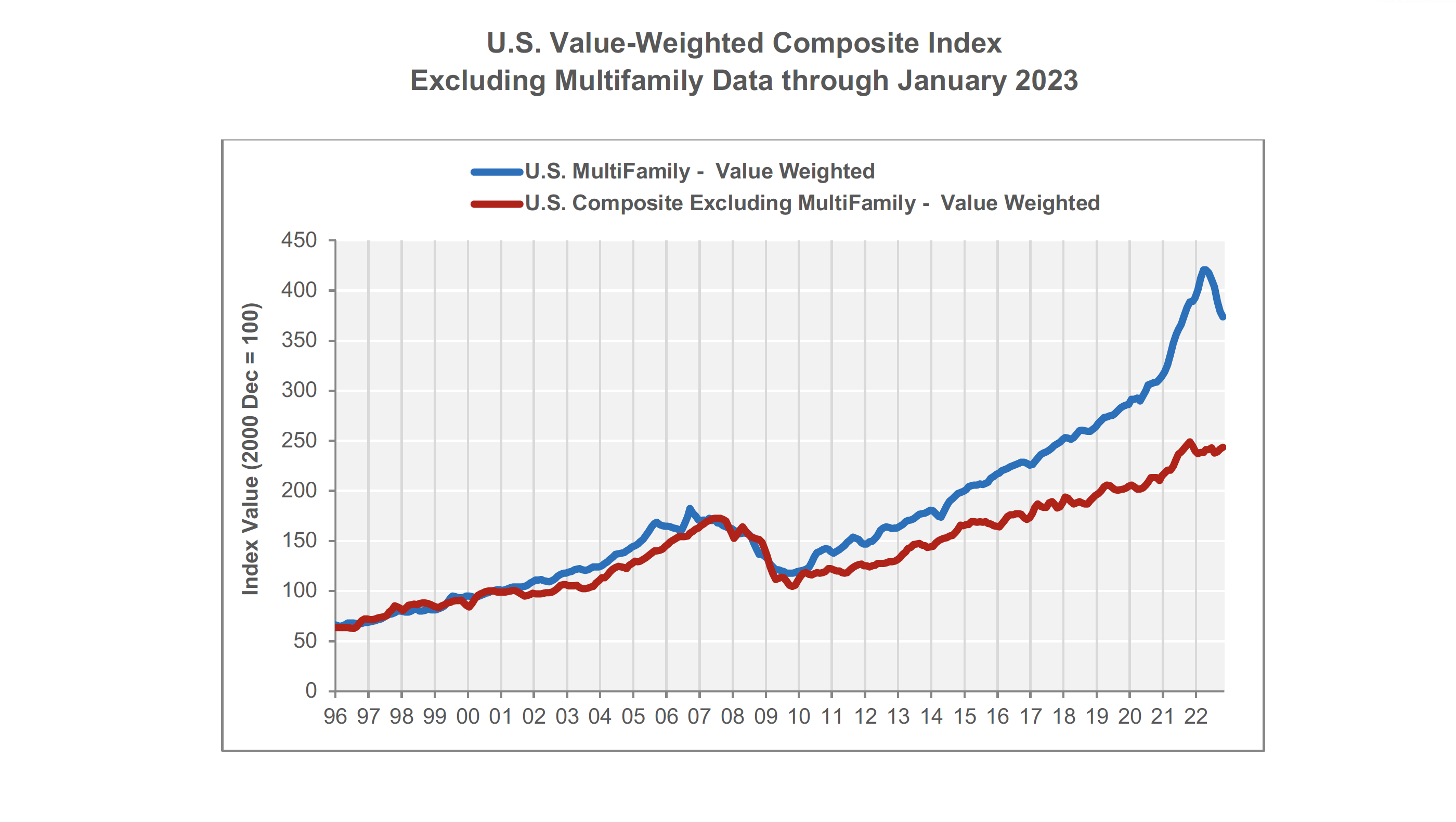

THE MULTIFAMILY SECTOR DROVE MOST OF THE PRICE GAINS IN THE VALUE-WEIGHTED INDEX OVER THE PAST DECADE. However, that sub-index has fallen in the past seven consecutive months.

-

The multifamily sector sub-index fell by 1.3% in January 2023, posting the sixth consecutive month of declines and slowing the speed of descent felt in the prior two months. The index saw price declines of 3.7% in the 12-month period that ended in January 2023 but was 30.9% higher than in February 2020, before the onset of the pandemic. Net absorption in multifamily reached historic highs in 2021 in response to pandemic-era effects on the housing market, motivating double-digit annual price gains. However, affordability destruction through rental rate growth and a wave of new supply have together dampened absorption.

-

The multifamily sector sub-index fell by 1.4% in December 2022, its fifth month of decline since reaching a peak of 421 in June and July 2022. The index saw price growth of 1% in the 12-month period that ended in December 2022, its slowest year-over-year gain since June 2010, when the index recorded an annual decline. Net absorption in multifamily units reached historic highs in 2021 in response to pandemic-era impacts on the housing market, motivating double-digit annual price gains and making the sector an attractive asset class. However, with both prices and mortgage rates elevated, eroding affordability has tempered absorption more recently.

-

The value-weighted composite index excluding the multifamily sector climbed 0.9% higher in January 2023. The index fell 2.1% in the 12-month period that ended in January 2023 and is 20.1% higher than it was in February 2020, gaining two-thirds of the rate that the multifamily sub-index experienced during that same time.

-

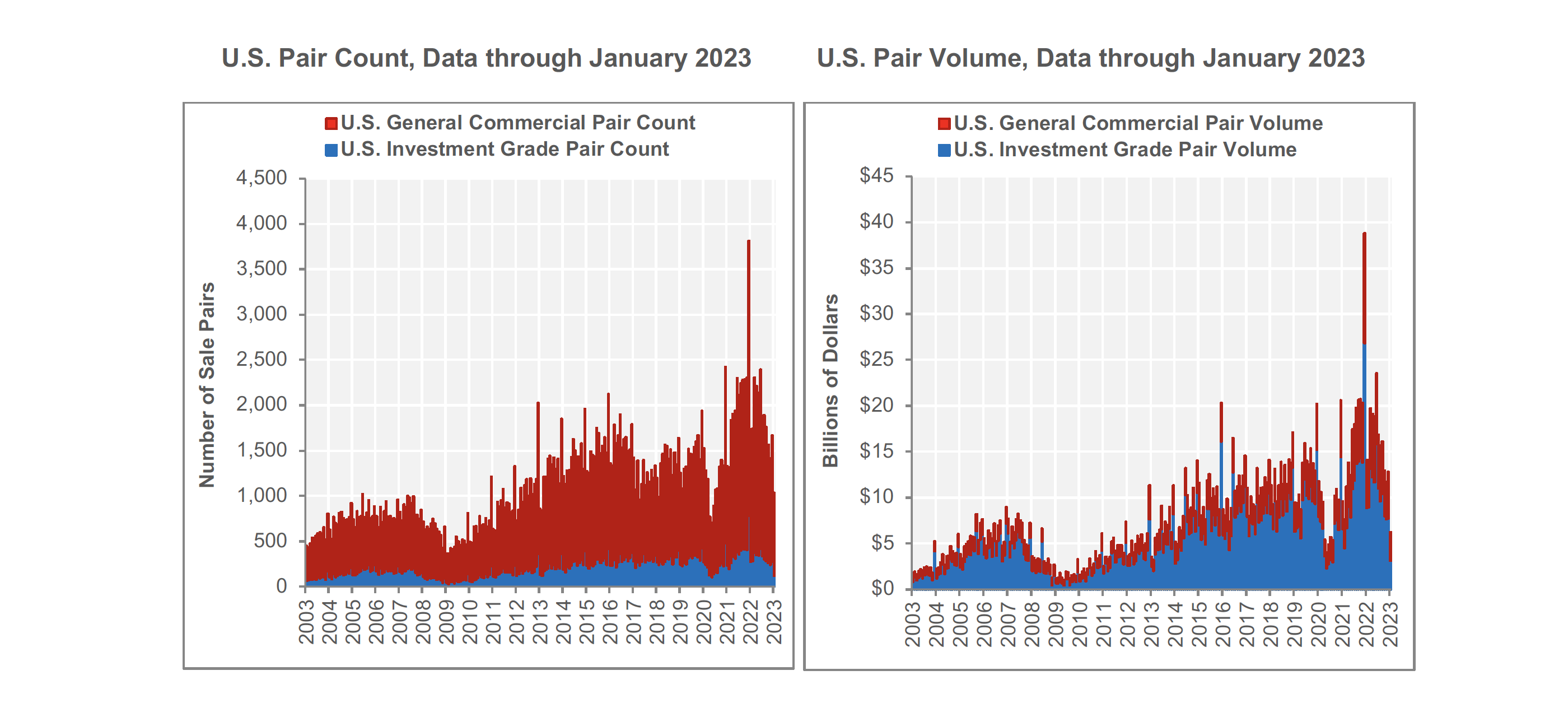

TRANSACTION VOLUME FELL IN JANUARY 2023 TO ITS LOWEST LEVEL SINCE AUGUST 2020. Transaction activity fell sharply in January 2023 to $6.3 billion, a 51% decline from the prior month’s volume. Investment grade segment transaction volume pulled back in January 2023 by 59.7% to $3.1 billion while the general commercial segment fell by 37.6% to $3.1 billion.

-

U.S. Composite pair volume of $187.6 billion during the 12-month period ending in January 2023 was 12.7% lower than the 12-month period ending in January 2022. The falloff was due to a steady volume decline through the back half of 2022, with January 2023 posting a fraction of the sales from the prior year. January pair volume of $6.3 billion was % below the $14.1 billion transacted in January 2022. Pair sales volume declines were primarily attributed to the investment grade segment with $119.1 billion in consideration in the 12-month period ending in January 2023, equating to a 16.3% decline over the prior 12 months. General commercial saw a lesser reduction in sales activity with $68.5 billion in pair volume through January 2023, corresponding to a 5.7% dip from the 12-month period ending in January 2022.

-

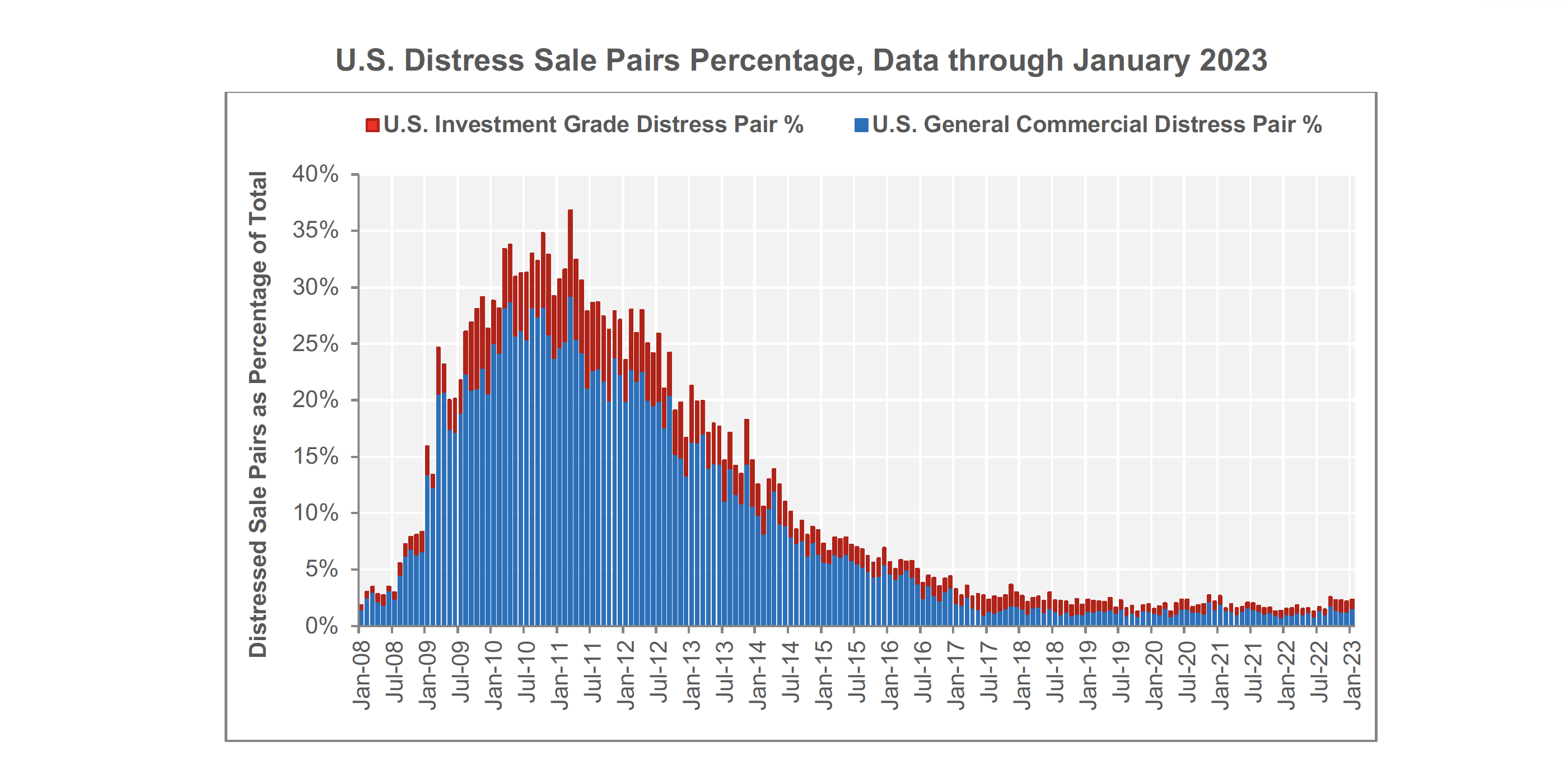

ALTHOUGH GENTLY CLIMBING, DISTRESSED REPEAT-SALE TRADES REMAIN NEAR HISTORIC LOWS. Approximately 2.3%, or 24, of the 1,032 repeat-sales trades were distressed in January 2023. Of the trades with distressed attributes, 17, or 1.65%, were from general commercial, while seven, or 0.68%, were from investment grade repeat-sales. Respectively, their three-year pre-pandemic averages were 1.4% for general commercial and 1% for investment grade. Total distressed sales during the three-year pre-pandemic era averaged 2.4%.

Quarterly CCRSI Property Type Results

-

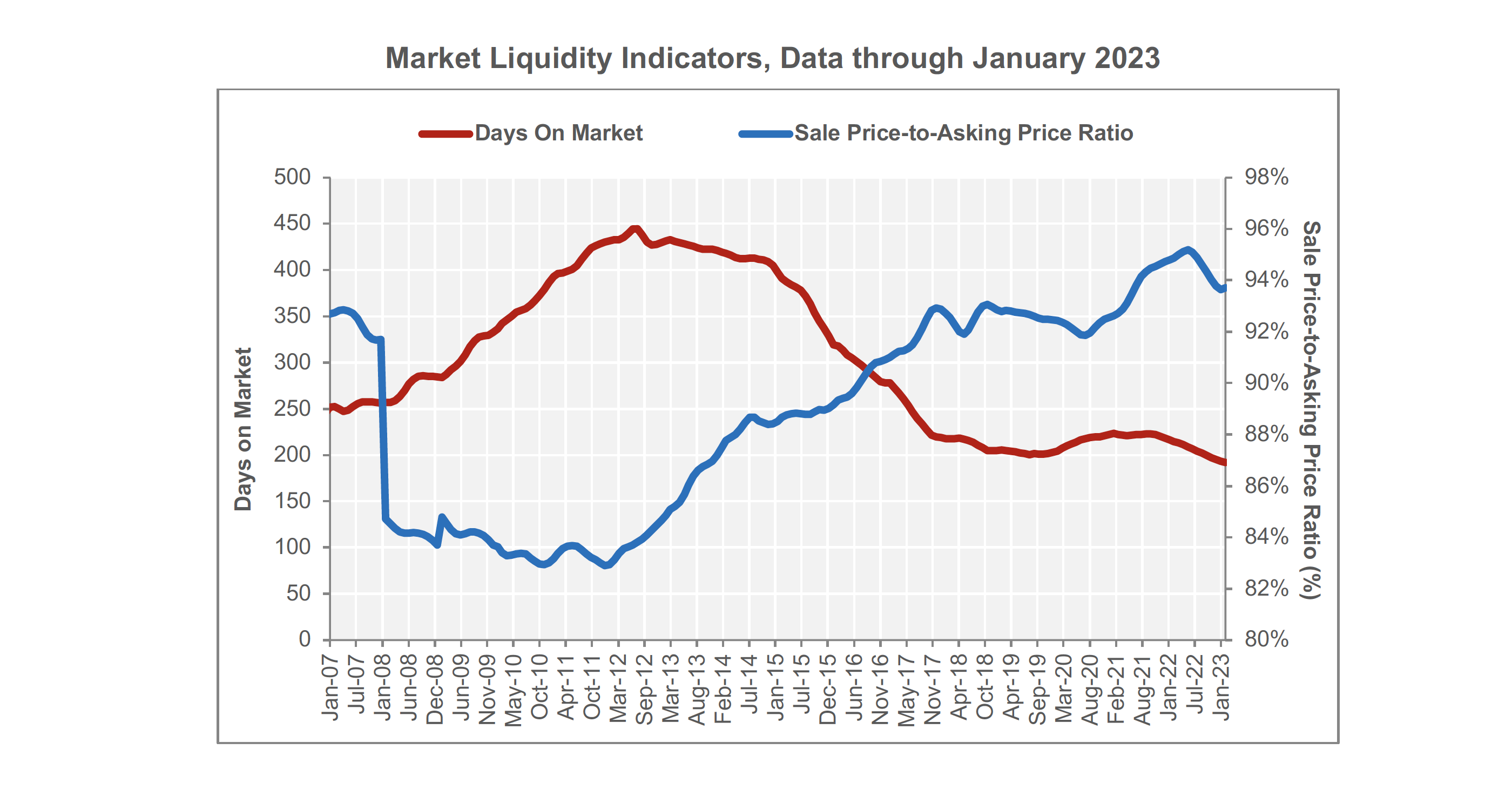

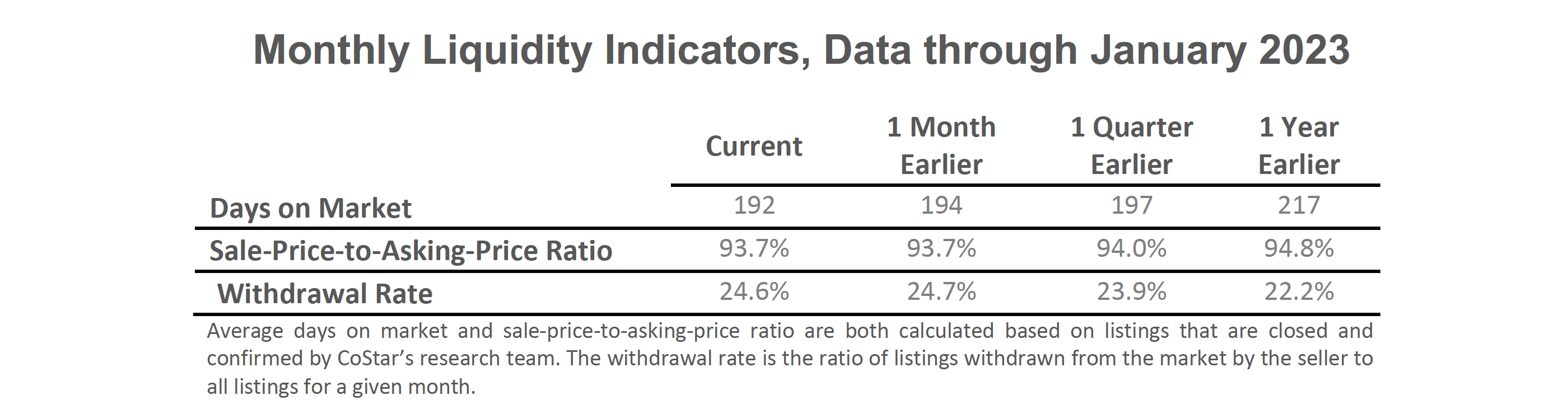

LIQUIDITY INDICATORS SUGGEST DEMAND IS SOFTENING. The average length of for-sale properties on the market fell in January 2023 for the 18th straight month to 191.83 days. The decline represents a 0.9% drop from the prior month and an 11% reduction from one year earlier. At the same time, the trade-to-ask-price ratio leveled off at 93.7% after seven months of attenuation. Despite the recent softening, buyers’ willingness to approximate sellers’ pricing expectations are still near historical highs and above the long-term trend dating back to 2006.

-

After seven months of consecutive increases, the share of properties withdrawn from the market due to sellers not hitting their price targets stepped back ten basis points to 24.6% in January 2023. Compared to the three-year pre-pandemic average of 27.5%, January’s withdrawal rate shows sellers are predominantly transacting within their expected value ranges.

About The CoStar Commercial Repeat-Sale Indices

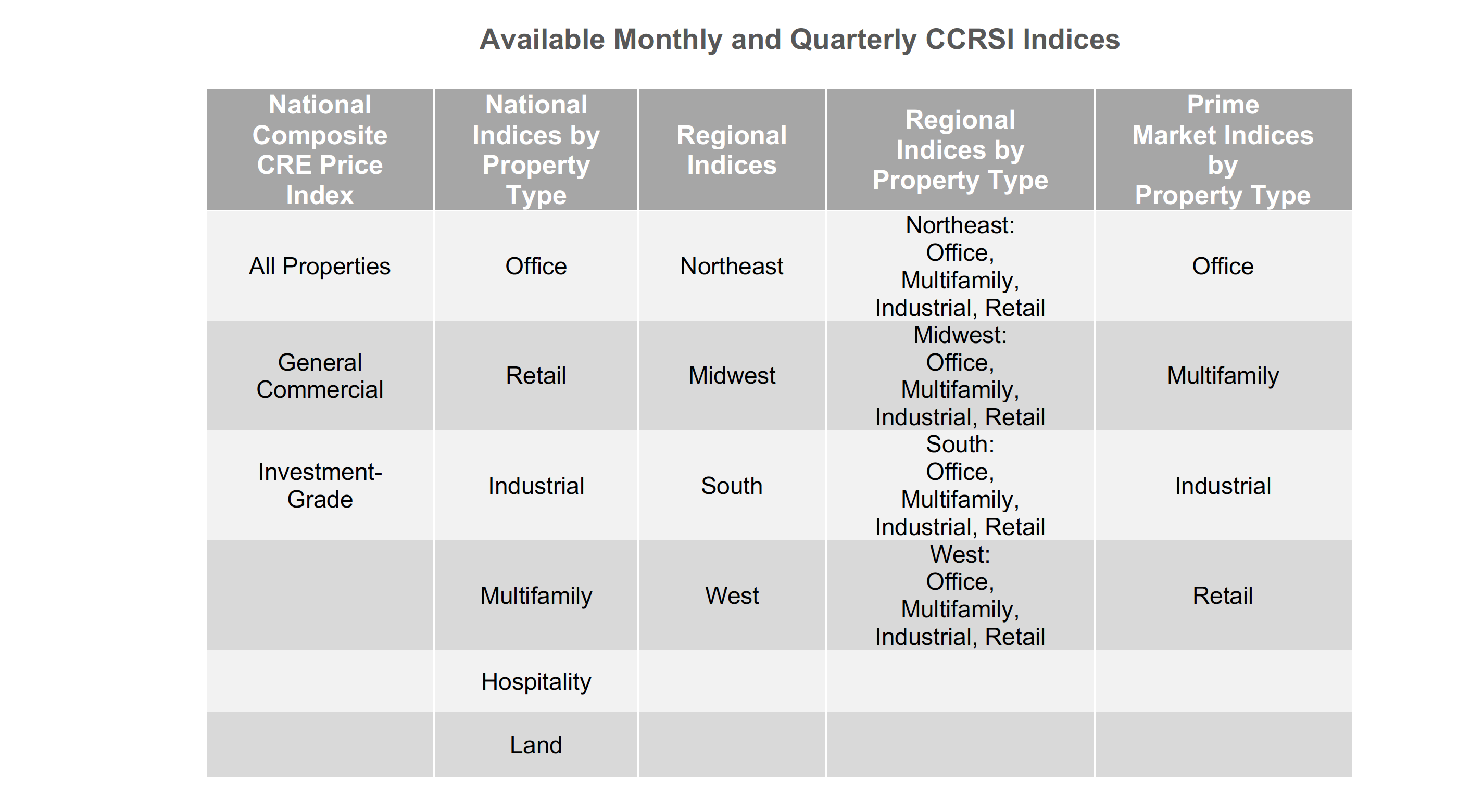

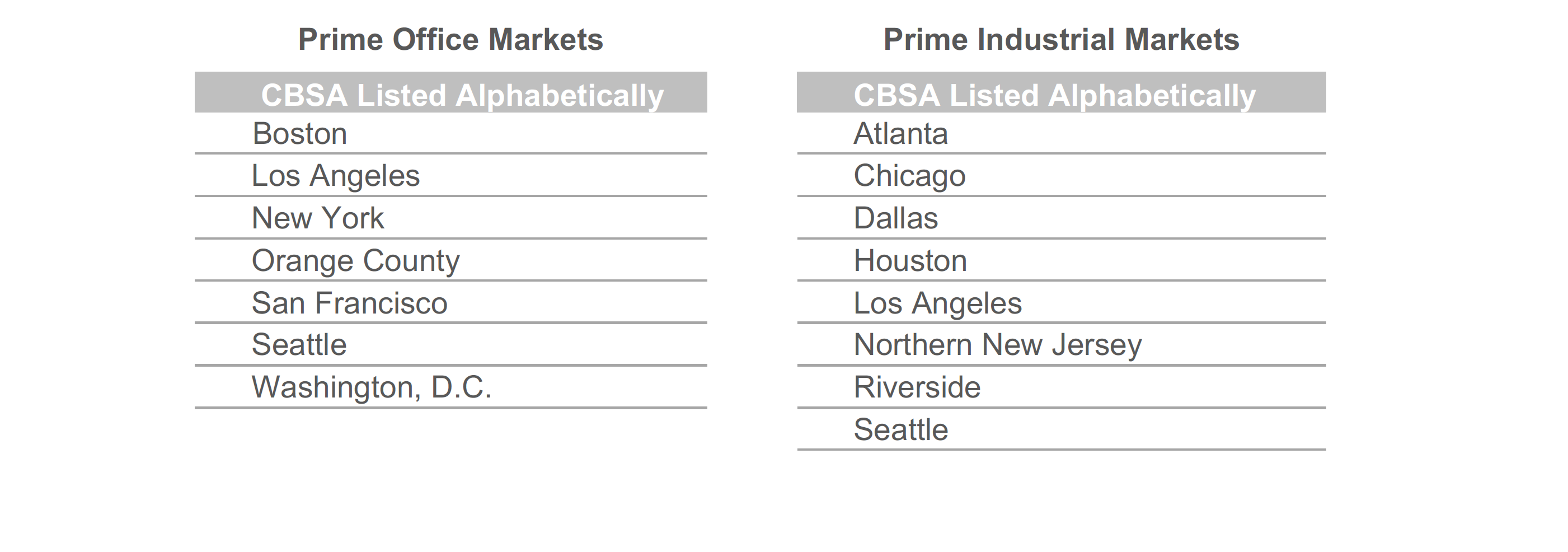

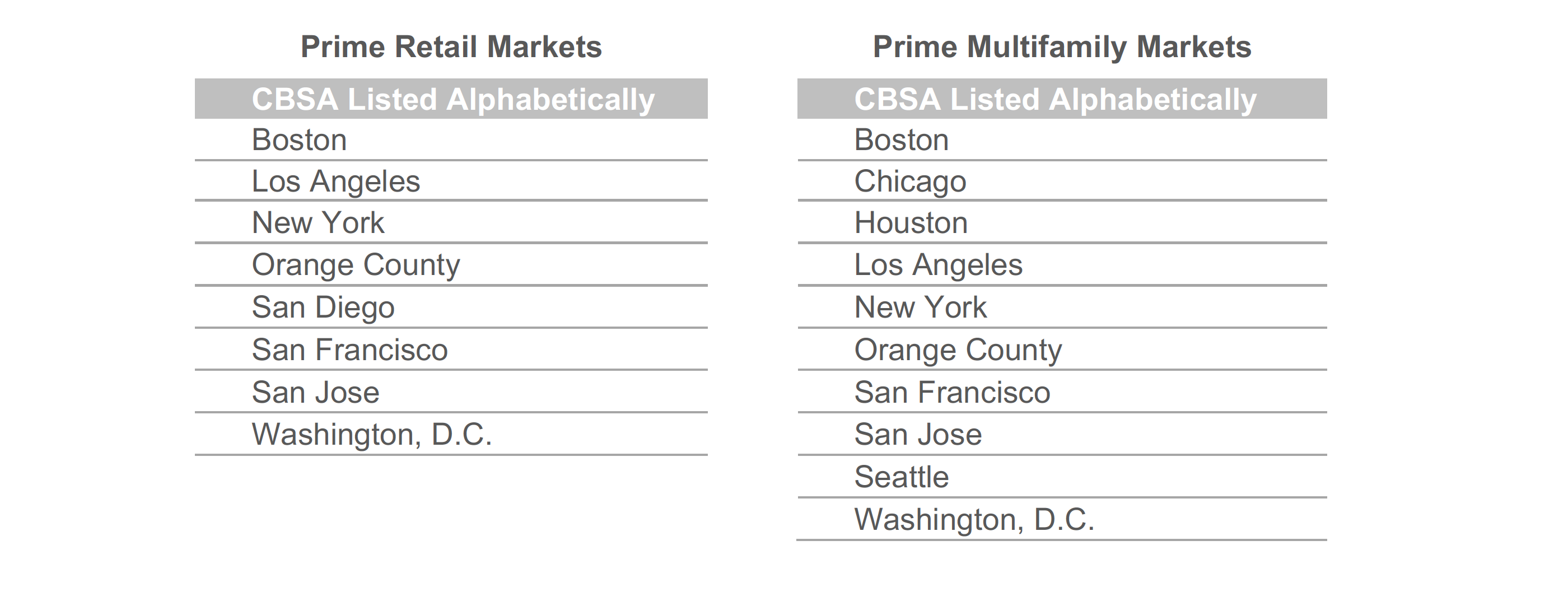

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which are reported monthly, 30 sub-indices in the CoStar index family are reported quarterly. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country).

The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all the sales pairs are used to create a price index. Historical price indices are revised as new data is recorded.

CONTACT:

Matthew Blocher, Vice President, Marketing & Communications, CoStar Group (mblocher@costar.com).

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices, and disclaimer, please visit http://costargroup.com/costar-news/ccrsi.

ABOUT COSTAR GROUP, INC.

CoStar Group, Inc. (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret, and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. Realla is the UK’s most comprehensive commercial property digital marketplace. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time we plan to utilize our corporate website, www.costargroup.com, as a channel of distribution for material company information. For more information, visit www.CoStarGroup.com